Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

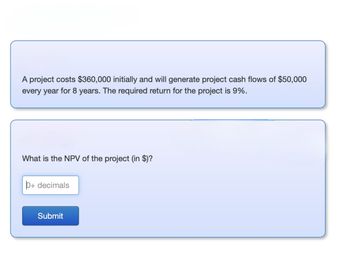

Transcribed Image Text:A project costs $360,000 initially and will generate project cash flows of $50,000

every year for 8 years. The required return for the project is 9%.

What is the NPV of the project (in $)?

p+ decimals

Submit

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Project L requires an initial outlay at t = 0 of $59,664, its expected cash inflows are $12,000 per year for 8 years, and its WACC is 14%. What is the project's IRR? Round your answer to two decimal places. %arrow_forwardA project has estimated annual net cash flows of $63,800. It is estimated to cost $740,080. Determine the cash payback period. Round the answer to one decimal place.____________ yearsarrow_forwardA project has an initial cost of $40,000, expected net cash inflows of $12,000 per year for 12 years, and a cost of capital of 12%. What is the project's MIRR? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- The cost of the project is $100,000. You expect the project to make $500,000 in 7years (CF of year 7 = $500,000). Youjr cost of capital is 15%. The IRR for this project equals___. A)25.85%B)23.94%C)22.01%D)17.85%arrow_forwardA project has an initial cost of $35,000, expected net cash inflows of $8,000 per year for 9 years, and a cost of capital of 13%. What is the project's PI? (Hint: Begin by constructing a time line.) Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardProject L requires an initial outlay at t = 0 of $70,000, its expected cash inflows are $8,000 per year for 9 years, and its WACC is 12%. What is the project's MIRR? Do not round intermediate calculations. Round your answer to two decimal places. A %arrow_forward

- A project that provides annual cash flows of $22,500 for 7 years costs $84,000 today. a. If the required return is 12 percent, what is the NPV for this project? b. Determine the IRR for this project.arrow_forwardProject A requires an initial outlay at t = 0 of $3,000, and its cash flows are the same in Years 1 through 10. Its IRR is 18%, and its WACC is 12% What is the project's MIRR? Donot round intermediate calculations. Round your answer to two decimal placesarrow_forwardProject L requires an initial outlay at t = 0 of $50,592, its expected cash inflows are $9,000 per year for 9 years, and its WACC is 11%. What is the project's IRR? Round your answer to two decimal places.arrow_forward

- Project L requires an initial outlay at t=0 of $78,952, Its expected cash inflows are $14,000 per year for 9 years, and its WACC is 9%. What is the project's IRR? Round your answer to two decimal places. %arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$1,400 $510 $600 $600 $380 $180 Payback years: _______.__arrow_forwardA project has estimated annual net cash flows of $57, 600. It is estimated to cost $288,000. Determine the cash payback period. Round the answer to one decimal place. yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education