Microeconomics: Principles & Policy

14th Edition

ISBN: 9781337794992

Author: William J. Baumol, Alan S. Blinder, John L. Solow

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

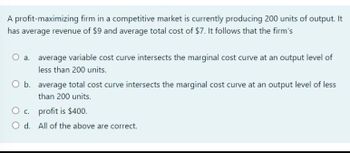

Transcribed Image Text:A profit-maximizing firm in a competitive market is currently producing 200 units of output. It

has average revenue of $9 and average total cost of $7. It follows that the firm's

O a. average variable cost curve intersects the marginal cost curve at an output level of

less than 200 units.

O b. average total cost curve intersects the marginal cost curve at an output level of less

than 200 units.

O c. profit is $400.

O d.

All of the above are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A computer company produces affordable, easy-to-use home computer systems and has fixed costs of 250. The marginal cost of producing computers is 700 for the first computer, 250 for the second, 300 for the third, 350 for the fourth, 430 for the fifth, 450 for the sixth, and 500 for the seventh. Create a table that shows the companys output, total cost, marginal cost, average cost, variable cost, and average variable cost. At what price is the zero-profit point? At what price is the shutdown point? If the company sells the computers for 500, is it making a profit or a loss? How big is the profit or loss? Sketch a graph with AC, MC, and AVG curves to illustrate your answer and show the profit or loss. If the firm sells the computers for 300, is it making a profit or a loss? How big is the profit or loss? Sketch a graph with AC, MC, and AVG curves to illustrate your answer and show the profit or loss.arrow_forwardIf new technology in a perfectly competitive market brings about a substantial reduction in costs of production, how will this affect the market?arrow_forwardA market in perfect competition is in long-run equilibrium. What happens to the market if labor unions are able to increase wages for workers?arrow_forward

- Firms ill a perfectly competitive market are said to be price takers that is, once the market determines an equilibrium price for the product, firms must accept this price. If you sell a product in a perfectly competitive market, but you are not happy with its price, would you raise the price, even by a cent?arrow_forwardExplain in words why a profit-maximizing film will not choose to produce at a quantity where marginal cost exceeds marginal revenue.arrow_forwardProductive efficiency and allocative efficiency are two concepts achieved in the long mm in a perfectly competitive market. These are the two reasons why we call them perfect. How would you use these two concepts to analyze other market structures and label them imperfect?arrow_forward

- The AAA Aquarium Co. sells aquariums for 20 each. Fixed costs of production are 20. The total variable costs are 20 for one aquarium, 25 for two units, 35 for the three units, 50 for four units, and 80 for five units. In the form of a table, calculate total revenue, marginal revenue, total cost, and marginal cost for each output level (one to five units). What is the Profit-maximizing quantity of output? On one diagram, sketch the total revenue and total cost curves. On another diagram, sketch the marginal revenue and marginal cost curves.arrow_forwardWhat two lines on a cost curve diagram intersect at the zero-profit point?arrow_forwardExplain how the profit-maximizing rule of setting P=MC leads a perfectly competitive market to be allocatively efficient.arrow_forward

- Briefly explain the reason for the shape of a marginal revenue curve for a perfectly competitive firm.arrow_forwardA firm in a competitive market receives 500 in total revenue and has marginal revenue of 10. What is the average revenue, and how many units were sold?arrow_forwardFinding a life partner is a complicated process that may take many years. It is hard to think of this process as being part of a very complex market, with a demand and a supply for partners. Think about how this market works and some of its characteristics, such as search costs. Would you consider it a perfectly competitive market?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning