ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

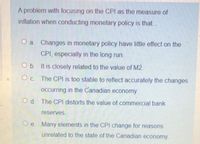

Transcribed Image Text:A problem with focusing on the CPI as the measure of

inflation when conducting monetary policy is that...

O a. Changes in monetary policy have little effect on the

CPI, especially in the long run.

O b. It is closely related to the value of M2.

O c. The CPl is too stable to reflect accurately the changes

occurring in the Canadian economy.

O d. The CPI distorts the value of commercial bank

reserves,

e. Many elements in the CPI change for reasons

unrelated to the state of the Canadian economy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The CPI understates true inflation because it does not take into account consumers' ability to substitute toward goods that become relatively cheaper over time. Select one: O True O Falsearrow_forwardMaps Paraphrasing Tool ... New Tab ent - Sem 2 2022.pdf 2 / 3 G Report Grammarly 100% + + » What is the current environment in the USA and Australia? b) Define unemployment and its measurement. What is the current environment in the USA and Australia? c) Define inflation and its measurement. What is the current environment in the USA and Australia? Question 2 Assume that an economy is initially operating at the natural rate of output (full employment output). Use the AD-AS model to illustrate graphically the effects on price and output of a increase in government spending and an increase in the cash rate. Explain your assumptions with respect to the range of aggregate supply of your analysis. Question 3 Explain in detail the process of Monetary Policy transmission of an increase in the cash interest rate. Use relevant graphs to describe how a Central Bank's action on the interest cash rate ripple through the economy and lead to the target policy goal. (Three connected diagrams should…arrow_forward2 of 2) - Google Chrome lu.om/mod/quiz/attempt.php?attempt=1835779&cmid=880584&page=1 EARNING SYSTEM (ACADEMIC) Time left 0:32:25 ion Exhibit 6-3 it of Year CPI e flag 1 141.5 139.2 142.3 146.6 Refer to Exhibit 6-3. Prices changed by percent between year 2 and year 3. Select one: O a. 1.6 O b. 2.2 O c. 1.9 O d. 2.3 O e. 2.7 on Table 20-17 tix MAG241C 1500R 144arrow_forward

- 4) If actual inflation is more than expected inflation, which of the following groups will most certainly benefit? а. Lenders b. Borrowers с. Minorities d. Women е. Men Suppose that the consumer price index of a country was 160 at year-end 2004 and 168 at the 5) end of 2005. What was the country's inflation rate during 2005? 5 percent b. а. 8 percent 60 percent d. с. 68 percent 6) If the consumer price index (CPI) at the end of year one was 100 and was 108 at the end of year two, the inflation rate during year two was zero; the CPI of 100 indicates that prices were stable. b. а. 8 percent. 5 percent. d. c. 108 percent.arrow_forward12arrow_forwardQuestion 3 In Germany, banks are paying a positive interest rate on peoples' savings, as a result O a. Savers are worse off if the inflation rate in Germany is zero O b. Savers are better off if the inflation rate in Germany exceeds the nominal interest rate Oc. Savers are worse off if the deflation rate in Germany is zero O d. Savers are better off if the deflation rate in Germany is zeroarrow_forward

- ٧arrow_forward4. As the general price level changes, substitution bias in price indices results in underestimation of the change in the cost of living. 5. A core inflation index is typically calculated by taking the CPI and excluding volatile economic variables. 9. Inflation can help nullify problems created by sticky nominal wages, because with inflation real wages can fall even if nominal wages are constant.arrow_forwardK Suppose in 2018, the United Kingdom economy was at full employment Nominal GDP was £2,730 billion, the real interest rate was 3 percent per year, the inflation rate was 3 percent a year, and the price level was 130 Calculate the nominal interest rate In the long run, if the real interest rate remains the same but the inflation rate increases to 6 percent a year, how does the nominal interest rate change? The nominal interest rate is percent a year In the long run, if the real interest rate remains the same but the inflation rate increases to 6 percent a year, then the nominal interest rate percearrow_forward

- 81arrow_forward2. Explaining short-run economic fluctuations A majority of economists believe that in the long run, real economic variables and nominal economic variables behave independently of one another. For example, an increase in the money supply, a no long-run effect on the quantity of goods and services the economy can produce, a and nominal variables is known as variable, will cause the price level, a AL AXIS However, in the short run, most economists believe that real and nominal variables are intertwined. Economists use the model of aggregate demand and aggregate supply to examine the economy's short-run fluctuations around the long-run output level. The following graph shows an incomplete short-run aggregate demand (AD) and aggregate supply (AS) diagram-it needs appropriate labels for the axes and curves. In the questions that follow you will identify some of the missing labels. AS variable, to increase but will have variable. The distinction between real variables ?arrow_forwardon The quality change bias is most likely to put The quality change bias is most likely to put_ into the CPI and so.... into the CPI and so O a. a downward bias; understate O b. a random bias; randomly overstate or understate O c. an upward bias; understate O d. a downward bias; overstate e. an upward bias; overstate Clear my choice the inflation rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education