FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

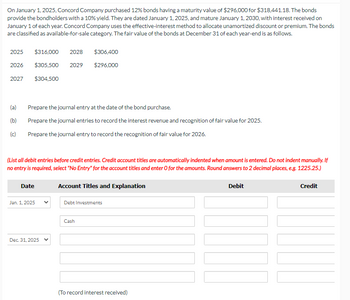

Transcribed Image Text:On January 1, 2025, Concord Company purchased 12% bonds having a maturity value of $296,000 for $318,441.18. The bonds

provide the bondholders with a 10% yield. They are dated January 1, 2025, and mature January 1, 2030, with interest received on

January 1 of each year. Concord Company uses the effective-interest method to allocate unamortized discount or premium. The bonds

are classified as available-for-sale category. The fair value of the bonds at December 31 of each year-end is as follows.

2025 $316,000 2028

$305,500 2029

$304,500

2026

2027

(a) Prepare the journal entry at the date of the bond purchase.

(b)

Prepare the journal entries to record the interest revenue and recognition of fair value for 2025.

(c)

Prepare the journal entry to record the recognition of fair value for 2026.

(List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 2 decimal places, e.g. 1225.25.)

Account Titles and Explanation

Date

Jan. 1, 2025

$306,400

$296,000

Dec. 31, 2025

Debt Investments

Cash

(To record interest received)

Debit

Credit

Transcribed Image Text:Dec. 31, 2026

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 5. On 1 January 2021 Corgi Ltd issued a £5m convertible bond at nominal value. There were no issue costs. The bond is redeemable at par on 1 January 2024 or bond holders can convert their bond into ordinary shares, with a nominal value of £1. The terms of the conversion are 2 shares for every £100 of bond. The coupon rate on the bond is 10%, payable annually in arrears. Bonds issued by similar entities without the conversion rights bear interest at 15%.arrow_forwardWhen determining the amount of interest to be paid on a bond, which of the following information is not necessary? a. The length of the interest period, annually or semiannually b. The face rate of interest on the bonds c. The face amount of the bonds d. The selling price of the bondsarrow_forwardWhich of the following documents must be executed at closing to create a binding relationship between the property being offered as collateral and the loan financing it? An escrow agreement and a mortgage A promissory note and a mortgage or deed of trust A promissory note and a property conveyance binder A mortgage or a deed of trust and a recordable affidavitarrow_forward

- Blossom Company sold $3,300,000, 6%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022 and pay interest annually on January 1. Blossom Company uses the straight-line method to amortize bond premium or discount. (a)arrow_forwardA $2,600 credit balance in the Premium on Bonds Payable account represents which of the following? Select one: a. An overpayment for a bond purchase b. An underpayment for a bond purchase c. The current amount of amortization expense d. The unamortized amount of premium earned on a bond issuearrow_forwardBOND PRICING #2 for Borrowing Money Inc Borrowing Money Inc (BMI) issues a bond on January 1, 2021 with a face valuc of $400,000. The bond has an 7 year maturity date and requires SEMI ANNUAL interest paymerits. The bond's stated interest rate is 3% and the current market interest rate is 2%. Hint: remember to set your expectations PV tables will be needed. Do not round your PVIF, but you may round answers to whole dollars. Prepare the journal entry (in proper form) at issuance of this bond for BMI. Include your journal for grading on your PDF upload. Your multiple step calculations must also be shown To get a preliminary idea of how you did you may enter your calculated amount for cash received at Issuancearrow_forward

- What assumption about the future composite rate of interest on an adjustable-rate mortgage is made when determining the APR for federal truth-in-lending disclosures?arrow_forwardDonna Clark Company issued $612,000 of 9%, 20-year bonds on January 1, 2025, at 101. Interest is payable semiannually on July 1 and January 1. Clark Company uses the straight-line method of amortization for bond premium or discount. Prepare the journal entries to record the following.arrow_forwardPrepare a schedule of interest expense and bond amortization for 2025-2027. (Round answer to 2 decimal places, e.g. 38,548.25.) Date 1/1/25 $ 12/31/25 12/31/26 12/31/27 Cash Paid Schedule of Interest Expense and Bond Premium Amortization Effective-Interest Method $ Interest Expense $ Premium Amortized $ Carry Value ofarrow_forward

- Concord Hills Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 5% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 3% when the bonds were issued at a price of 109. Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable accountarrow_forwardFrom page 9-3 of the VLN, what are the cash flows from a bond that must be present valued back to today? Group of answer choices A. The face amount only B. The interest payments only C. The issue price only D. The face amount and interest paymentsarrow_forwardOn September 30, 2012, Cullumber Company issued 10% bonds with a par value of $460,000 due in 20 years. They were issued at 98 and were callable at 105 at any date after September 30, 2017. Because Cullumber Company was able to obtain financing at lower rates, it decided to call the entire issue on September 30, 2018, and to issue new bonds. New 9% bonds were sold in the amount of $780,000 at 102; they mature in 20 years. Cullumber Company uses straight-line amortization. Interest payment dates are March 31 and September 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education