Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

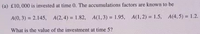

Transcribed Image Text:(a) £10, 000 is invested at time 0. The accumulations factors are known to be

A(0, 3) = 2.145, A(2,4) 1.82,

A(1,3) = 1.95, A(1, 2) = 1.5, A(4,5) = 1.2.

%3D

%3D

%3D

What is the value of the investment at time 5?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forwardWhat is the payback period for an investment of $10000 with net revenues as follows: year 1: $5000, Year 2: $3000, Year 3: $2000, Year 4: $5000, Year 5: $3000. A. 2 years B. 3 years C. 4 years D. 5 yearsarrow_forwardAssume a $290,000 investment and the following cash flows for two products: Year Product X 1 A234 4 $ 100,000 100,000 75,000 40,000 Product Y $ 90,000 100,000 Product X Product Y 80,000 40,000 a. Calculate the payback for products X and Y. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. years years b. Which alternative would you select under the payback method? Product X is selected O Product Y is selectedarrow_forward

- For each of the investments below, calculate the rate of return earned over the period. Cash Flow During Period - $900 14,000 5,000 70 1,500 (Click on the icon here in order to copy the contents of the data table above into a spreadsheet.) Investment A B C D E Beginning-of-Period End-of-Period Value Value $1,400 140,000 55,000 500 14,000 $400 115,000 49,000 200 12,600arrow_forward1.4 The table represents the cash flows received from the investments at the end year. Each investment requires an initial investment of $1000. Answer the questions related to the two investment opportunities in the table below. Year 1 2 3 4 5 Investment A 225 215 250 225 205 Investment B 220 225 250 250 210 There are two approaches to evaluate this investment. Show the necessary calculations. • Assume the interest rate ot 4.33%. Use present value analysis to determine which investment you should choose? Calculating the rate of returns of the investment, which investment would you choose and why?arrow_forwardNet cost of investment is 100,000. Profitability index is 1.3 while cost of capital is 10%. Useful life is 10 years. Use up to two decimal places for the PVF. What is the ARR? A• 42.35% B• 21.17% C• 22.34% D• 30%arrow_forward

- P 9-1 Investment Scenarios (LO 9-3) Arkansas Best Freightways is considering a purchase of three different potential trucks. it is considering three different investment scenarios and their respective cash flows. Arkansas Best Freightways use a cost of capital of 9 percent to evaluate the investments. Year Year 0 (today) Year 1 Year 2 Year 3 Year 4 Buy new truck Increased profits Increased profits Increased profits Increased profits Net cash flows over life (not discounted) Investment 1 (85,000) 25,000 25,000 25,000 25,000 $ Investment 2 (105,000) 20,000 30,000 40,000 50,000 Required: 1. Calculate the net cash flows (not discounted) over the life of the three investments (years 0 to 4). (Negative amounts should be entered using a minus sign.) Answer is complete and correct. Investment 1 15,000 Investment 2 $ Investment 3 (125,000) 40,000 30,000 20,000 10,000 Investment 3 (25,000) 35,000 S Cost of Capital 9%arrow_forward3. * The force of interest (t) at time t (measured in years) is a + bt² where a and b are constants. An amount of £200 at time t = 0 accumulates to £210 at t = 5 and £230 at t = 10. 1 (a) Show that a = log (1.05) - 30 log(1.15) = 0.008352, and b = 250 log(1.15) - 125 log(1.05) = 0.0001687. (b) Compute A(0, 7) and hence compute the discounted value at t = 0 of a payment of £750 due at t = 7. (c) Compute A(6, 7). What is the equivalent constant annual interest rate for the year from t = 6 to t = 7? (d) Calculate the constant force of interest that would give rise to the same accumulation from t = 0 to t = 10.arrow_forwardQ4. Your project has following Cashflows: Time Cashflow 0 B).19.14% C).21.08% D).21.68% 1 -25,000.00 5,000.00 35,000.00 The reinvestment rate is 10% and refinancing rate is 15%. What is MIRR?.. A).19.73% 2 10,000.00 3 - 5,000.00 4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education