Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

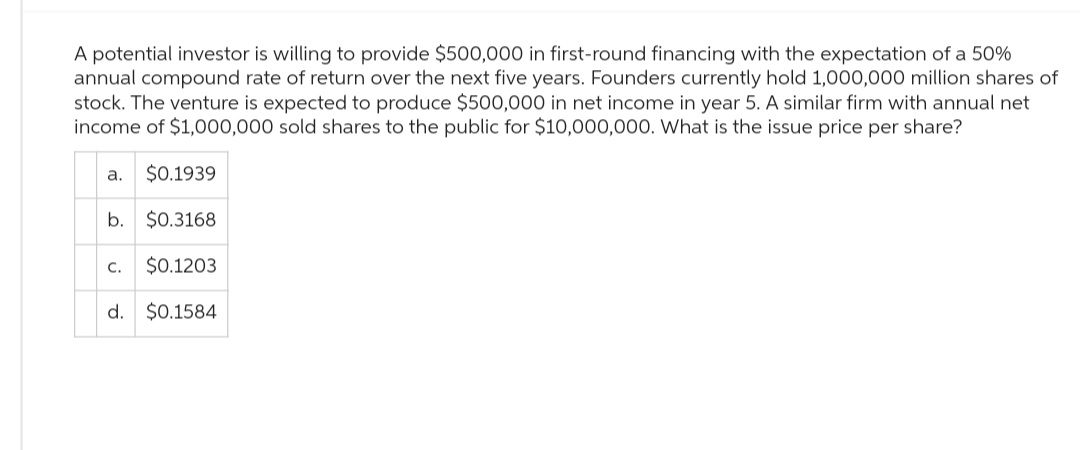

Transcribed Image Text:A potential investor is willing to provide $500,000 in first-round financing with the expectation of a 50%

annual compound rate of return over the next five years. Founders currently hold 1,000,000 million shares of

stock. The venture is expected to produce $500,000 in net income in year 5. A similar firm with annual net

income of $1,000,000 sold shares to the public for $10,000,000. What is the issue price per share?

a. $0.1939

$0.3168

$0.1203

d. $0.1584

b.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You were offered to buy shares of stock of a newly listed company. You decided to take 300 shares at Php 1200 per share. You plan on selling these shares when the market value doubles. If the prevailing rate of increase is 12% per year, how long do you expect to wait until you decide to sell your shares of stock? Explain your answer. Note: please sketch the cash flow diagram.arrow_forwardK Zoom Enterprises expects that one year from now it will pay a total dividend of $4.8 million and repurchase $4.8 million worth of shares. It plans to spend $9.6 million on dividends and repurchases every year after that forever, although it may not always be an even split between dividends and repurchases. If Zoom's equity cost of capital is 13.2% and it has 4.7 million shares outstanding, what is its share price today? The price per share is $ (Round to the nearest cent.)arrow_forwardZoom Enterprises expects that one year from now it will pay a total dividend of $4.5 million and repurchase $4.5 million worth of shares. It plans to spend $9.0 million on dividends and repurchases every year after that forever, although it may not always be an even split between dividends and repurchases. If Zoom's equity cost of capital is 13.5% and it has 4.9 million shares outstanding, what is its share price today?arrow_forward

- You are considering two investment options. In option A, you have to invest $4,500 now and $700 three years from now. In option B, you have to invest $3,700 now, $1,900 a year from now, and $900 three years from now. In both options, you will receive four annual payments of $1,800 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 8% interest? Assume that all cash flows occur at the end of a year. Click the icon to view the interest factors for discrete compounding when i = 8% per year. ..... (a) The conventional payback period for option A is 3 years. (Round to the nearest whole number place.) The conventional payback period for option B is 4 years. (Round to the nearest whole number place.) Which of these options would you choose based on the conventional payback criterion? Choose the correct answer below. O A. Option B O B. Both options are…arrow_forwardYou are negotiating with your underwriters in a firm commitment offering of 10 million primary shares. You have two options: set the IPO price at $25.00 per share with a spread of 8%, or set the price at $24.20 per share with a spread of 6%. Which option raises more money for your firm?arrow_forwardWhite Lion Homebuilders has a current stock price of $27 per share, and is expected to pay a per-share dividend of $4.60 at the end of next year. The company’s earnings and dividends growth rate are expected to grow at a constant rate of 5.10% into the foreseeable future. If Alpha Moose expects to incur flotation costs of 3.90% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be _____? (22.83%, 21.69%, 18.26%, or 26.25%) Please answer fast I give you like.arrow_forward

- You are considering the purchase of Yudee Ha, Inc. The firm just paid a dividend of P4.85 per share. The stock is selling for P135 per share. Security analyst agrees with top management in projecting steady growth of 11% in dividends and earnings ovewr the foreseeable future. Your required rate of return for stock of this type is 17.5%. If you were to purchase and hold the stock for three years, what would the expected dividends be worth today? 2. Divergent, Inc. has a weighted average cost of capital of 11.5%. Its target capital structure is 55% equity and 45% debt. The company has sufficient retained earnings to fund the equity portion of its capital budget. The before-tax cost of debt is 9% and the company tax rate is 30%. If the expected dividend next period is P5 and the current stock price is P45, what is the company’s growth rate? Answer 1 and 2 with solutionarrow_forwardWest Central plc has been quoted on the London Stock Exchange for 10 years. Analysis of data from the last 10 years suggests that the company has an equity beta of 1.20. The company has 60 % of equity and 40 % of debt. The current market value of West Central plc is $ 100 million. The company is going to undertake a project that has a similar beta to its average assets. The project is expected to be financed entirely by equity. As a result of this financing option and the undertaking of the project, the company will have 70 % of equity and 30 % of debt measured at market values. The risk-free rate is expected to be 5 % per annum and the market is expected to return 10 % per annum. West Central plc pays corporate tax at 40 %. The company's debt is thought to be risk-free. a ) Calculate the company's beta before the proposed project. b) Calculate the company's market value after the proposed project and the financing option. c) Calculate the Net Present Value of the project. d)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education