Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

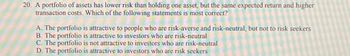

Transcribed Image Text:20. A portfolio of assets has lower risk than holding one asset, but the same expected return and higher

transaction costs. Which of the following statements is most correct?

A. The portfolio is attractive to people who are risk-averse and risk-neutral, but not to risk seekers

B. The portfolio is attractive to investors who are risk-neutral

C. The portfolio is not attractive to investors who are risk-neutral

D. The portfolio is attractive to investors who are risk seekers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements correctly describe characteristics of a risk averse investor? Group of answer choices A. A risk-averse investor may be willing to give up some expected return in order to be exposed to a higher level of risk. B. Given a choice, a risk-averse investor will always choose the investment with the lower level of risk when deciding between two investments offering different levels of expected return. C. More than one of the other statements is correct. D. A risk-averse investor will demand compensation in the form of higher expected returns in order to take on investments with higher risk.arrow_forwardAnswer whether each of the following statements is correct and explain your argument. \ (a) According to CAPM, the expected return of a risky asset is larger than the risk free rate. (b) According to CAPM, the expected return of a risky asset increases with its variance. (c) According to the separation property, the optimal risky portfolio for an investor dependson the investor’s personal preference. (d) A less risk-averse investor has a steeper indifference curve for the utility function.arrow_forwardWhen describing the attitude of investors towrds risk, which statement is correct? A.Investors may behave as though they are risk seekers for small investments B.For a risk-averse investor, the standard deviation of the return distribution is a relevant measure of risk C.Investors behave as though they are risk averse for investments of significant size D.All of the abovearrow_forward

- Which of the following statements is correct concerning a mean-variance efficient portfolio of risky assets in a world where there is also a risk-free asset? OA. It will be impossible to form a different portfolio yielding a lower level of risk unless the portfolio also earns a lower return, O B. Risk averse investors will only choose to invest in the market portfolio (M) regardless of the risk-free rate. OC. The portfolio will always achieve the maximum possible returns. O D. The portfolio will always be inside the feasible set.arrow_forwardList which of the following statement(s) concerning risk are correct? 1. Nondiversifiable risk is measured by beta. II. The risk premium increases as diversifiable risk increases. III. Systematic risk is another name for nondiversifiable risk. IV. Diversifiable risks are market risks you cannot avoid.arrow_forward5) Which of the following statement(s) is(are) false regarding the selection of a portfolio from those that lie on the capital allocation line? 1.I) Less risk-averse investors will invest more in the risk-free security and less in the optimal risky portfolio than more risk-averse investors. 2.II) More risk-averse investors will invest less in the optimal risky portfolio and more in the risk-free security than less risk-averse investors. 3.III) Investors choose the portfolio that maximizes their expected utility. A) I only B) II only C) III only D) I and III E) II and III Justify the correct answer.arrow_forward

- After combining a riskfree asset with the efficient frontier of risky portfolios, you no longer need to know an investor's preferences over risk and return to identify the risky portfolio they should hold. Group of answer choices True Falsearrow_forwardWhich of the following choices best completes the following statement? Explain. An investor with a higher degree of risk aversion, compared to one with a lower degree, will most prefer investment portfoliosa. with higher risk premiums.b. that are riskier (with higher standard deviations).c. with lower Sharpe ratios.d. with higher Sharpe ratios.arrow_forwardIn the standard model of investment management, investors care only for: a. The return and the risk of their portfolio. b. The return, the risk and the degree of ambiguity of their portfolio. c. The return of their portfolio when the market is bullish. d. The relative level of profit they will make in comparison to other investors.arrow_forward

- As investors become more pessimistic (risk averse): Select one: a. they invest in a portfolio with a high beta. b. prices of securities fall in order to raise their expected rate of return. c. they require larger betas for taking risk. d. they require smaller premiums for taking risk.arrow_forwardIn a few sentences, answer the following question as completely as you can. We routinely assume that investors are “risk-averse return-seekers” (i.e., they like returns and dislike risk). If so, why do we contend that only systematic risk is important? Alternatively, why is total risk, on its own, not important to investors?arrow_forward1. The diversifiable risk of a portfolio: a. Is correlated with systematic risk. b. Can be made sufficiently small. c. Is zero in the real world. d. Is the risk that investors lose because of transaction costs. Which one of the following conditions determines the investor’s overall optimal portfolio? a. The marginal ratio of substitution of the investor’s utility function must be equal to the Sharpe ratio of the optimal risky portfolio. b. The standard-deviation of the overall portfolio in minimised. c. The expected return of the overall portfolio is maximised. d. The slope of the Sharpe-ratio is equal to zero. 4. Markets can never be strong-form efficient because: a. There are too many traders in them. b. Investors are rational. c. Information is costly to acquire. d. All information is public. 5. Which one of the following is not a property of a pure arbitrage portfolio? a. Zero investment. b. Zero systematic risk. c. Positive net return. d. All of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education