ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

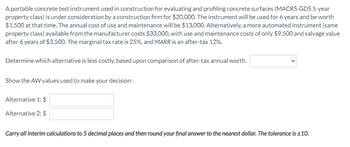

Transcribed Image Text:A portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year

property class) is under consideration by a construction firm for $20,000. The instrument will be used for 6 years and be worth

$1,500 at that time. The annual cost of use and maintenance will be $13,000. Alternatively, a more automated instrument (same

property class) available from the manufacturer costs $33,000, with use and maintenance costs of only $9,500 and salvage value

after 6 years of $3,500. The marginal tax rate is 25%, and MARR is an after-tax 12%.

Determine which alternative is less costly, based upon comparison of after-tax annual worth.

Show the AW values used to make your decision:

Alternative 1: $

Alternative 2: $

Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle?arrow_forwardSpeedy Delivery Incorporated is updating its delivery system control equipment. As the lead facilitiesengineering manager, you have to select the best option for the product line. Your team has researched the market and found four options but only the three shown below will meet the technical needs of the company. The company as a 6 year contract for their services and needs the equipment for all 6 years. The financial manager has told you that you need to consider MARR of 10% to meet company guidelines. You are not given any product profit and quantity information, since that is company confidential and held at very high levels in the company. So you can only make your decision on your cash flow/discount analysis. Based on discussions with senior management in your division, you have decided to use a present–worth criterion to make your recommendation. The options are shown below; pick the best option for the Company and be sure to justify your recommendation by using present worth…arrow_forwardCompare the alternatives C and D on the basis of a present worth analysis using an interest rate of 15.00% per year and a study period of 10 years. (Include a minus sign if necessary.) Alternative First Cost AOC, per Year Annual Increase in Operating Cost, per Year Salvage Value Life, Years The present worth of alternative C is $ с $-50000 $-8000 $-1500 $14000 10 $-21000 $-9000 $-200 $1500 5 and that of alternative D is $arrow_forward

- An independent contractor for a transportation company needs to determine whether she should upgrade the vehicle she currently owns or trade her vehicle in to lease a new vehicle. If she keeps her vehicle, she will need to invest in immediate upgrades that cost $4,700 and it will cost $1,450 per year to operate at the end of year that follows. She will keep the vehicle for 6 years; at the end of thi period, the upgraded vehicle will have a salvage value of $4,300. Alternatively, she could trade in her vehicle to lease a new vehicle. Sh estimates that her current vehicle has a trade-in value of $9.300 and that there will be $4,500 due at lease signing. She further estimates that it will cost $3,300 per year to lease and operate the vehicle. The independent contractor's MARR is 12%. Compute the EUAC of both the upgrade and lease alternatives using the insider perspective. Click here to access the TVM Factor Table Calculator. EUAC(keep): EUAC(lease): $ S Carry all interim calculations to…arrow_forwardA portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year property class) is under consideration by a construction firm for $18,000. The instrument will be used for 6 years and be worth $3,000 at that time. The annual cost of use and maintenance will be $13,500. Alternatively, a more automated instrument (same property class) available from the manufacturer costs $27.000,with use and maintenance costs of only $8.500 and salvage value after 6 years of $1,500. The marginal tax rate is 25%, and MARR is an after-tax 12%. Determine which alternative is less costly, based upon comparison of after-tax annual worth. Show the AW values used to make your decision: Alternative 1: $ Alternative 2: S Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10.arrow_forwardWhite Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, HVAC, and other equipment with newer models in the entire center built 9 years ago. The original purchase price of the equipment was $766,000 nine years ago and the operating cost has averaged $240,000 per year. Determine the equivalent annual cost of the installed equipment, if the company can now sell it for $160,000. The company’s MARR is 25% per year. The equivalent annual cost of the installed equipment is $−arrow_forward

- Mechanical engineer at Company B is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which should be selected (a) if they are independent, and (b) if they are mutually (c) Explain why your selection in part (b) is correct. First Cost, $ Net Annual Income, $/Year Life, Years A -20,000 +5,500 4 B −10,000 +2,000 6 C −15,000 3,800 6 D −60,000 +11,000 12 E −80,000 +9,000 12arrow_forward(2) If the initial investment on the equipment is 25000 and it will have a salvage value of 5000 at the end of 5 years. It will save 8000 per year for the study period. Is it worthwhile to install the equipment? Justify it by using Future Worth (FW) formulation when MARR is 20%arrow_forwardA consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle? 10 16 -22)arrow_forward

- Ee 353.arrow_forwardA portable concrete test instrument used in construction for evaluating and profiling concrete surfaces (MACRS-GDS 5-year property class) is under consideration by a construction firm for $24,000. The instrument will be used for 6 years and be worth $1,000 at that time. The annual cost of use and maintenance will be $11,000. Alternatively, a more automated instrument (same property class) available from the manufacturer costs $28,500, with use and maintenance costs of only $7,500 and salvage value after 6 years of $2,500. The marginal tax rate is 25%, and MARR is an after-tax 12%.Determine which alternative is less costly, based upon comparison of after-tax annual worth. select an alternative Show the AW values used to make your decision:Alternative 1: $enter a dollar amount Alternative 2:arrow_forwardAn oil company plans to purchase a piece of vacant land on the corner of two busy streets for $50,000. On properties of this type, the company installs businesses of three different types. Each has an estimated useful life of 15 years. The salvage land for each is estimated to be the $50,000 land cost. Cost* $ 83,000 Type of Business Conventional gas station Add automatic carwash Add quick carwash 195,000 115,000 *Improvements cost does not include $50,000 for the land. Plan A B с Net Annual Income $26,500 39,750 31,200 (a) Construct a choice table for interest rates from 0% to 100%. (b) If the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education