ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

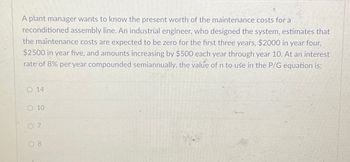

Transcribed Image Text:A plant manager wants to know the present worth of the maintenance costs for a

reconditioned assembly line. An industrial engineer, who designed the system, estimates that

the maintenance costs are expected to be zero for the first three years, $2000 in year four,

$2500 in year five, and amounts increasing by $500 each year through year 10. At an interest

rate of 8% per year compounded semiannually, the value of n to use in the P/G equation is:

O 14

O 10

07

7

08

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Nippon Steel's expenses for heating and cooling a large manufacturing facility are expected to increase according to an arithmetic gradient beginning in year 2. If the cost is $550,000 this year (year 0) and will be $550,000 again in year 1, but then it is estimated to increase by $41,000 each year through year 12, what is the equivalent annual worth in years 1 to 12 of these energy costs at an interest rate of 9.00% per year? The equivalent annual worth is determined to be $arrow_forwardToday, an engineer deposited $10,000 into an account that pays interest at 8% per year compounded semiannually. If there is no interperiod compounding and withdrawals of $1000 in months 2, and 23 are already planned, what will be the future value at the end of 3 years? The future value would be $arrow_forwardLevi Strauss has some of its jeans stone-washed under a contract with independent U.S. Garment Corp. If U.S. Garment's operating cost per ma- chine is $22,000 per year for years 1 and 2 and then it increases by 8% per year through year 10, what is the equivalent uniform annual cost per machine (years 1-10) at an interest rate of 10% per year?($28,029.93)arrow_forward

- Improvised explosive devices (IEDs) are responsible for many deaths in times of strife and war. Unmanned ground vehicles (robots) can be used to disarm the IEDs and perform other tasks as well. If the robots cost $165,000 each and the military arms unit signs a contract to purchase 3,500 of them now and another 9,000 one year from now, what is the equivalent annual cost of the contract over a 10- year period at 9% per year interest? The equivalent cost of the contract is determined to be $2254312500arrow_forwardAn engineering technology group just purchased new CAD software for P85,000 now and annual payments of P15,000 per year for six years starting 3 years from now for annual upgrades. What is the equivalent annual cost of the all the payments made if the interest rate is 8% per year?arrow_forwardHow much must you deposit each year into your retirement account starting now and continuing through year 15 if you want to be abl to withdraw $100,000 per year forever, beginning 34 years from now? Assume the account earns interest at 15% per year. The amount to be deposited is determined to be $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education