FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![A partial statement of financial position of Ivanhoe Ltd. on December 31, 2022, showed the following property, plant, and equipment

assets accounted for under the cost model (accumulated depreciation includes depreciation for 2022):

Buildings

$294,000

Less: Accumulated depreciation

94,000

Equipment

$125,000

Less: Accumulated depreciation 45,000

(a)

Ivanhoe uses straight-line depreciation for its building (remaining useful life of 20 years, no residual value) and for its equipment

(remaining useful life of 8 years, no residual value). Ivanhoe applies IFRS and has decided to adopt the revaluation model for its

building and equipment, effective December 31, 2022. On this date, an independent appraiser assessed the fair value of the building

to be $146,000 and that of the equipment to be $100,000.

(To eliminate the accumulated depreciation)

Prepare the necessary general journal entries, if any, to revalue the building and the equipment as at December 31, 2022, using

the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

(To adjust the Buildings

account to fair value)

$200,000

(To eliminate the accumulated

depreciation)

80,000

(To adjust the Equipment

account to fair value)

Debit

Credit

]][[[[](https://content.bartleby.com/qna-images/question/87fad0ee-75c5-4ca6-8c36-51ba51c6cde6/e0dc9d33-f81d-4635-9cb0-94872fc2f0d2/d7guuyx_thumbnail.png)

Transcribed Image Text:A partial statement of financial position of Ivanhoe Ltd. on December 31, 2022, showed the following property, plant, and equipment

assets accounted for under the cost model (accumulated depreciation includes depreciation for 2022):

Buildings

$294,000

Less: Accumulated depreciation

94,000

Equipment

$125,000

Less: Accumulated depreciation 45,000

(a)

Ivanhoe uses straight-line depreciation for its building (remaining useful life of 20 years, no residual value) and for its equipment

(remaining useful life of 8 years, no residual value). Ivanhoe applies IFRS and has decided to adopt the revaluation model for its

building and equipment, effective December 31, 2022. On this date, an independent appraiser assessed the fair value of the building

to be $146,000 and that of the equipment to be $100,000.

(To eliminate the accumulated depreciation)

Prepare the necessary general journal entries, if any, to revalue the building and the equipment as at December 31, 2022, using

the asset adjustment method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

(To adjust the Buildings

account to fair value)

$200,000

(To eliminate the accumulated

depreciation)

80,000

(To adjust the Equipment

account to fair value)

Debit

Credit

]][[[[

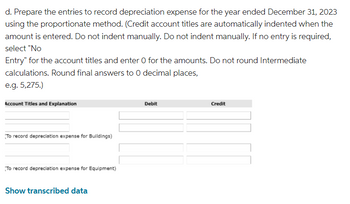

Transcribed Image Text:d. Prepare the entries to record depreciation expense for the year ended December 31, 2023

using the proportionate method. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. Do not indent manually. If no entry is required,

select "No

Entry" for the account titles and enter O for the amounts. Do not round Intermediate

calculations. Round final answers to 0 decimal places,

e.g. 5,275.)

Account Titles and Explanation

To record depreciation expense for Buildings)

To record depreciation expense for Equipment)

Show transcribed data

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The T-accounts for Equipment and the related Accumulated Depreciation-Equipment for Sheffield Company at the end of 2022 are shown here. Equipment Beg. bal. 79,800 Disposals 23,700 Acquisitions 37,400 End. bal. 93,500 Accumulated Depreciation-Equipment Disposals 5,200 Beg, bal 44,500 Depr. exp. 12.200 End, bal 51.500 In addition, Sheffield's income statement reported a loss on the disposal of plant assets of $4,000. What amount was reported on the statement of cash flows as "cash flow from sale of equipment"? (Show amount that decrease cash flow with either a-sign eg-15,000 or in parenthesis eg. (15,000)) Cash flow from sale of equipment Sarrow_forwardMaria Company had the following property, plant, and equipment at December 31, 2014:Cost Book ValueLand 4,000,000 4,000,000Office building 30,000,000 22,500,000Machinery 6,000,000 3,000,000 These assets are carried under the cost model since their acquisition on January 3, 2005. The straight linemethod is used in computing depreciation charges. Assume that the residual value is immaterial. On January 2,2015, Maria decided to adopt the revaluation mode. Accordingly, reputable appraisers submitted the followingfair values: Land – P10,000,000 Office Building – P37,500,000 Machinery – P5,000,000There was no change in useful life. The office building has 40 years of useful life, while machinery is beingdepreciated over 20 years. On January 5, 2017, the Company had these assets subjected to a secondrevaluation. Result of the second revaluation show the following sound values: Land – P8,000,000 Office Building –P22,750,000* Machinery – P2,000,000* Maria uses the proportional approach in…arrow_forwardPresented below is information related to equipment owned by Bramble Company at December 31, 2025. Cost Accumulated depreciation to date. Expected future net cash flows Fair value $10,260,000 (a) 1.140,000 7,980,000 5,472,000 Assume that Bramble will continue to use this asset in the future. As of December 31, 2025, the equipment has a remaining useful life of 5 years. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No entry for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.) ternunt Titles and Fynlanation Debit Credit SUPPORTarrow_forward

- On March 31, 2024, the Herzog Company purchased a factory complete with vehicles and equipment. The allocation of the total purchase price of $900,000 to the various types of assets along with estimated useful lives and residual values are as follows: Asset Land Building Equipment Vehicles Total Cost $ 150,000 400,000 200,000 150,000 $ 900,000 Estimated Residual Value N/A none 12% of cost $ 15,000 Estimated Useful Life (in years) N/A 25 On June 29, 2025, equipment included in the March 31, 2024, purchase that cost $90,000 was sold for $70,000. Herzog uses the straight-line depreciation method for building and equipment and the double-declining-balance method for vehicles. Partial-year depreciation is calculated based on the number of months an asset is in service. Required 1 Required 2 Required 3 Building Equipment Vehicles Required: 1. Compute depreciation expense on the building, equipment, and vehicles for 2024. 2. Prepare the journal entries to record the depreciation on the…arrow_forwardThe plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2023: Plant Asset Accumulated Depreciation $ 480,000 245,000 2,150,000 1,184,000 215,000 Land Land improvements Building Equipment Automobiles Transactions during 2024 were as follows: a. On January 2, 2024, equipment was purchased at a total invoice cost of $325,000, which included a $6,800 charge for freight Installation costs of $40,000 were incurred in addition to the invoice cost. b. On March 31, 2024, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $32,000. The fair value of the building on the day of the donation was $21,000. c. On May 1, 2024, expenditures of $63,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those originally anticipated. d. On…arrow_forwardOn March 31, 2021, Company A purchased a manufacturing facility along with vehicles and other equipment. The distribution of the total purchase price of $1,500,000 to the various types of assets, along with the estimated useful lives and residual values is as follows: The purchase on March 31, 2021 included equipment at the purchase cost of $150,000. The company sold equipment for $120,000 on June 29, 2022. Company A uses the following depreciation methods: straight-line depreciation method for buildings and equipment double-declining-balance method for vehicles Company A calculates partial-year depreciation based on the number of months an asset is in service. Company A Asset & Cost Land $150,000 Building $750,000 Equipment $360,000 Vehicles $240,000 Total $1,500,000 On June 29, 2022, equipment inculded in the March 31, 2021, purchase that cost $150,000 and was sold for $120,000. Company A uses the straight line depreciation method for buildings and equipment and the…arrow_forward

- At 30 June 2020, White Ltd reported the following cash-generating unit, with the carrying amount totaling $530,000: Land 200,000 Equipment 600,000 Accumulated (300,000) depreciation - Equipment Goodwill 30,000 All items of property, plant and equipment are measured using the cost model. At 30 June 2020, the recoverable amount of the cash-generating unit was $480,000. For the period ending 30 June 2021, the depreciation charge on the equipment was $38,000. If the equipment had not been impaired the charge would have been $41,000. At 30 June 2021, the recoverable amount of the unit was calculated to be $15,000 greater than the carrying amount of the assets of the unit. As a result, White Ltd recognized a reversal of the previous year's impairment loss. Required: Prepare the journal entries relating to impairment at 30 June 2020 and impairment reversal at 30 June 2021.arrow_forwardPresented below is information related to Wolfie Corp.’s equipment on 12/31/2022: Description Amount Capitalized cost $900,000 Accumulated depreciation to date 750,000 Estimated residual value 40,000 Expected future cash flows 125,000 Estimated Fair value 100,000 The amount of the impairment loss, if any, that Wolfie Corp. should record on 12/31/22 is: $45,000 $50,000 $10,000 $20,000 $25,000 There is no impairment.arrow_forwardInformation related to plant assets, natural resources, and intangible assets at the end of 2022 for Windsor, Inc. is as follows: buildings $1,060,000, accumulated depreciation-buildings $648,000, goodwill $409,000, coal mine $501,000, and accumulated depletion-coal mine $103,000. Prepare a partial balance sheet of Windsor, Inc. for these items. (List Property, Plant and Equipment in order of Coal Mine and Buildings.) Windsor, Inc. Balance Sheet (partial) $ $ $arrow_forward

- Concord Corp's statement of financial position at the end of 2022 included the following items: Current assets Land Buildings Equipment Accumulated depreciation-buildings Accumulated depreciation equipment Intangible assets-patents. Total 1 2 3. 4. 5. The following information is available for the 2023 fiscal year: 6. 7. 8. 5. 6. 7. 8 9. $1,265,000 (a) 30,100 1,210,000 330,000 (141,000) (12,200) 40,200 $2.722,100 December 31, 2023 Concord prepares financial statements in accordance with IFRS. Assets Current liabilities Bonds payable Common shares Retained earnings Concord Corp. Statement of Financial Position Total $1,128,100 Net income was $409,000. Interest paid is treated as an operating activity. Equipment (cost of $21.600 and accumulated depreciation of $8,080) was sold for $10,800. Depreciation expense was $4.150 on the building and $9,160 on equipment. Amortization expense on a patent was $3,110. 1,221,000 Current assets other than cash increased by $33,000. Current liabilities…arrow_forwardVinubhaiarrow_forwardFollowing are the details related to fixed assets of Jackson company as at December 31, 2022: Date of Residual Purchase January 1, 2020 $15,000 April 1, 2015 1,000 Asset Machinery Delivery Van September 30, 2018 Furniture 500 December 31, 2012 Building 25,000 Required: Estimated Useful Life 30 Years 12 Years 8 Years 40 Years Cost $ 550,000 45,000 72,000 1,250,000 Value 1. Calculate the annual depreciation for each of the fixed assets given above. 2. Determine the book value of each fixed asset as on December 31, 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education