ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

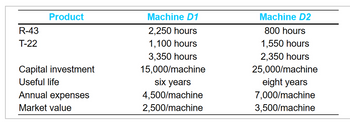

Transcribed Image Text:The table presents a comparison between two machines, D1 and D2, in terms of various operational and financial metrics. Below is the detailed transcription of the information provided:

**Product:**

- **R-43**

- Machine D1: 2,250 hours

- Machine D2: 800 hours

- **T-22**

- Machine D1: 1,100 hours

- Machine D2: 1,550 hours

- **Total**

- Machine D1: 3,350 hours

- Machine D2: 2,350 hours

**Additional Metrics:**

- **Capital Investment**

- Machine D1: $15,000 per machine

- Machine D2: $25,000 per machine

- **Useful Life**

- Machine D1: Six years

- Machine D2: Eight years

- **Annual Expenses**

- Machine D1: $4,500 per machine

- Machine D2: $7,000 per machine

- **Market Value**

- Machine D1: $2,500 per machine

- Machine D2: $3,500 per machine

This detailed comparison aids in evaluating the efficiency, cost-effectiveness, and operational lifespan of each machine within an industrial or manufacturing context.

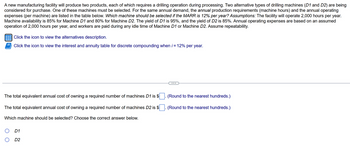

Transcribed Image Text:**Machine Selection for New Manufacturing Facility**

A manufacturing facility is set to produce two products, both requiring a drilling operation. Two types of drilling machines, D1 and D2, are considered for purchase. These machines must meet the same annual demand. Consider the following details for selection at a Minimum Attractive Rate of Return (MARR) of 12% per year:

- **Assumptions:**

- Operation: 2,000 hours annually.

- Machine Availability:

- D1: 85%

- D2: 80%

- Yield:

- D1: 95%

- D2: 85%

- Workers are paid for any idle time.

For further details:

- Click the icon to view alternative descriptions.

- Click the icon to view the interest and annuity table for discrete compounding when *i* = 12% per year.

**Cost Analysis**

1. **Total Equivalent Annual Cost for D1:** $ ___ (Round to nearest hundreds)

2. **Total Equivalent Annual Cost for D2:** $ ___ (Round to nearest hundreds)

**Decision Point**

Which machine should be selected? Choose from the options:

- D1

- D2

Please complete the calculations to determine the most cost-effective machine for purchase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a hybrid vehicle with a sticker price of $31,500. These vehicles will average 30 miles per gallon of gasoline. $1,500 tax credit for hybrid vehicles Effectively reduce the sticker price to $30,000. A gasoline-only vehicle that Comparablely equipped will cost $28,000 and will average 25 miles per gallon of gasoline. Assuming an interest rate of 3% per year and a five-year study period, find the cost gasoline breakeven ($/gal)arrow_forwardThe MARR is 7% per year, capital investment is $118,864, annual expense is $30,127, annual revenue is $89,754, salvage value is $18,093, The study period is 10 years. What is the AW?arrow_forwardDecision D6, which has three possible choices (X, Y, or Z), must be made in year 3 of a 6-year study period in order to maximize EPW). Using an MARR of 18% per year, the investment required in year 3, and the estimated cash flows for years 4 through 6, determine which decision should be made in year 3. High Low High 06 Low 2 High Low Investment, Cash Flow, (Year Cash Flow, $1000 Cash Flow, Year 31 3) (Year 4) $1000 (Year 5) Cash Flow, $1000 (Year 6) Outcome Probability 3 4 5 6 High (X) $-150,000 $50 $50 $50 0.5 Low (X) $40 $30 $20 0.5 High (Y) $-73,000 $30 $40 $50 0.45 Low (Y) $30 $30 $30 0.55 High (Z) $-240,000 $190 $170 $150 0.7 Low (Z) $-30 $-30 $-30 0.3 The present worth of X is $arrow_forward

- As a project engineer, you received the AW analysis below from the finance department. It is for a new piece of equipment you ordered some months ago. You were told the interest rate used was 10% per year, but no first cost or projected salvage value was provided and you want to know them. Determine the values of P and S using the AW values for the year 3. Note: The AW values are equivalent values through the given year, not costs for the single year. Years Retained AW of First Cost, $ AW of Operating Cost, $ per Year AW of Salvage Value, $ 1 -51,700 -15,000 35,000 234 -27,091 -17,000 13,810 -18,899 -19,000 6,648 -14,827 -21,000 4,309 5 -12,398 -23,000 2,457 The value of P is $ 25,149.07 and the value of S is $ 8,853.89 Хarrow_forwardJ. Doe must choose between two different models. The analysis period considered is 6 years. Model 1 has a life of four years with a first cost of $13,500 and maintenance costs of $1,250 per year in years 2, 3, and 4 (no maintenance costs in year 1). The salvage value for this model at the end of its life is $4,271 (For year 2 the salvage value is $7,594). Model 2 has a life of three years with a first cost of $15,000 and maintenance costs of $700 per year. Its salvage value at the end of its life is $9,300 (year 3). Which of the two models should be chosen by J. Doe if considering a MARR of 12%.arrow_forwardRequired information A land development company is considering the purchase of earth-moving equipment. This equipment will have an estimated first cost of $214,000, a salvage value of $90,000, a life of 10 years, a maintenance cost of $42,000 per year, and an operating cost of $320 per day. Alternatively, the company can rent the necessary equipment for $1180 per day and hire a driver at $180 per day. When approached to rent for the breakeven number of days, the equipment owner indicated that the minimum rental is for 100 days per year; however, he might consider a lower daily rental cost. What is the daily rental cost to justify renting over purchasing? If the equipment was purchased, assume it would be used for the breakeven number of days. Determine the required rental cost per day. The daily rental cost to justify renting over purchasing is determined to be $arrow_forward

- The capitalized cost (CC) of the given project whose Cash Flow diagram is given below is closest to: = 10% per year 5 6 7 8 9 10 11 2 3 A= $2,000 PO=S30,000 C-55000 (Recurring every 5 y ears) C=55000 (Recurring every 5 years) Captalized Cost= ?arrow_forwardABC Beverage, LLC, purchases its 355-ml cans in large bulk from Wald-China Can Corporation. The finish on the anodized aluminum surface is produced by mechanical finishing technologies called brushing or bead blasting. Engineers at Wald are switching to more efficient, faster, and cheaper machines to supply ABC. Use the estimates and MARR = 8% per year to select between the two alternatives. Brush Alternative Bead Blasting Alternative P $-400,000 $-400,000 n 6 years large Salvage Value $50,000 no value AOC Nonlabor $-60,000 in year 1, decreasing by $2500 annually starting in year 2 $-70,000 per yeararrow_forward17) A professional photographer who specializes in wedding-related activities paid $24,800 for equipment that has a $2,000 estimated salvage value after five years. He estimates that his operating costs associated with hosting an event amount to $50 per day. If he charges $300 per day for his services, how many days (rounded up to the next integer) per year must he be employed in order to break even at an interest rate of 10% per year? (*arrow_forward

- The cost of the extending a certain road at Yellowstone National Park is $1.7 million. Resurfacing and other maintenance are expected to cost $350,000 every 3 years with an interest rate of 6% per year. a) What is the Annual Worth based capitalized cost of the road? b) How will the answer (a) change if its Salvage is expected to be $3 million at the end of its useful Life?arrow_forwardThe following five alternatives that are evaluated by the rate of return method, If the alternatives are independent and the MARR is 15% per year, the onels) to select is (are) Incremental ROR, N. When Compared with Alternative Initial Investment,S Alternative Alternative A BC DE 10.6 27.3 194 353 25.0 -25,000 -35,000 13.1 38.5 24.4 -40,000 13.4 46.5 27.3 26.8 -60,000 25.4 -75,000 20.2 Only D O Only D and E O Only A D, and E O Only Earrow_forwardBased on company records of similar equipment, a consulting aerospace engineer at Aerospatiale estimated AW values for a presently owned, highly accurate steel rivet inserter as shown. A challenger has ESL = 2 years and AWC= $−41,300 per year. The MARR is 12% per year. If Retained ThisNumber of Years The AW Value Is,$ per Year 1 −62,000 2 −51,000 3 −49,000 4 −53,000 5 −70,000 When should the next replacement evaluation take place, and under what assumption? The next replacement evaluation should take place in (Click to select) 4 2 3 5 years, and under the assumption that the (Click to select) defender challenger estimates do not change.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education