Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide Answer in blank

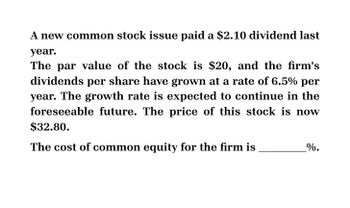

Transcribed Image Text:A new common stock issue paid a $2.10 dividend last

year.

The par value of the stock is $20, and the firm's

dividends per share have grown at a rate of 6.5% per

year. The growth rate is expected to continue in the

foreseeable future. The price of this stock is now

$32.80.

The cost of common equity for the firm is

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sidman Products’s common stock currently sells for $60.00 ashare. The firm is expected to earn $5.40 per share this year and to pay a year-end dividendof $3.60, and it finances only with common equity.a. If investors require a 9% return, what is the expected growth rate?b. If Sidman reinvests retained earnings in projects whose average return is equal tothe stock’s expected rate of return, what will be next year’s EPS?arrow_forwardA firm is expected to pay an annual dividend of $2.40 per share next year. The market price of stock is $75.25 and the growth rate is 2.5%. What is the cost of equity?arrow_forwardSalte Corporation is issuing new common stock at a market price of $27.00. Dividends last year were $1.45 and are expected to grow at an annual rate od 6.0 percent forever. What is Salte's cost of common equity?arrow_forward

- Mill Co. is expected to pay a dividend of $6 per share at the end of year -1(D1) and the dividends are expected to grow at a constant rate of 6.7% forever. If the current price of the stock is $55 per share calculate the expected return or the cost of equity capital for the firm.arrow_forwardOasis Corporation has a new common stock issue that paid a $2.10dividend last year. The par value of the stock is $20, and the firm's dividends per share have grown at a rate of 6.5% per year. The growth rate is expected to continue in the foreseeable future. The price of this stock is now $32.80. The cost of common equity for the firm is __%.arrow_forwardLlano's stock is currently selling for $40.00. The expected dividend one year from now is $2 and the required return is 13%. What is this firm's implied dividend growth rate? 3% O 5% 8% O 10% 13%arrow_forward

- The last dividend paid by Coppard Inc. was $1.25. The dividend growth rate is expected to be constant at 15% for 3 years, after which dividends are expected to grow at a rate of 6% forever. If the firm's required return (rs) is 11%, what is its current stock price?arrow_forwardXYZ corp expects to earn $3.8 per share next year and plow back 34.21% of its earnings (i.e., it expects to pay out a dividend of $2.5 per share, representing 65.79% of its earnings). The dividends are expected to grow at a constant sustainable growth rate and the stocks are currently priced at $30 per share. How much of the stock's $30 price is reflected in Present Value of Growth Opportunities (PVGO) if the investors' required rate of return is 20%? $arrow_forwardOcean Holding Corp.'s expected year-end dividend (D1) is $4.00, and its required return is 11 %. The company's dividend yield is 5.5 %, and its growth rate is expected to be constant in the future. What is the firm's stock price?arrow_forward

- The current market price of ABCD's stock is $30 per share. ABCD just paid a $2 dividend and its dividend is expected to grow by 5% in the coming year. The required rate of return for ABCD is 15%. What is ABCD's dividend yield and its capital gains yield? a. 6.7%; 8.3% b. 8%; 7% c. 5%; 10% d. 7%; 8% e. 10%; 5%arrow_forwardFrancis Inc.'s stock has a required rate of return of 10.25 %, and it sells for $30.00 per share. The dividend is expected to grow at a constant rate of 6.00% per year. What is the expected year-end dividend, D1? $1.28 $1.21 $1.08 $1.34 $1.47arrow_forwardThe XYZ Company paid $1.75 dividend yesterday. Its dividend growth rate is expected to be constant at 24.50% for 2 years, after which dividends are expected to grow at a rate of 5.65% forever. Its required return (rs) is 10.15%. What is the best estimate of the current stock price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT