Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

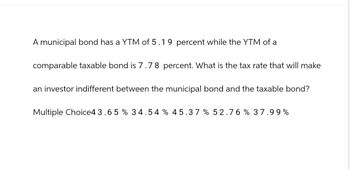

Transcribed Image Text:A municipal bond has a YTM of 5.19 percent while the YTM of a

comparable taxable bond is 7.78 percent. What is the tax rate that will make

an investor indifferent between the municipal bond and the taxable bond?

Multiple Choice4 3.65 % 34.54% 45.37 % 52.76 % 37.99%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q8 What is the taxable equivalent yield on a 4%, tax-exempt municipal bond for a person in the 30% tax bracket?arrow_forward3arrow_forwardQUESTION 5 Curtis invests $200,000 in a city of Athens bond that pays 4.00 percent interest. Alternatively, Curtis could have invested the $200,000 in a bond recently issued by Initech, Inc. that pays 5.00 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much after-tax earnings would Curtis have on the interest earned on the City of Athens bond? (Do not use $ or commas.)arrow_forward

- What is the solution? See the attached.arrow_forward2. Which statement is not correct? a) Municipal bonds tend to have a lower yield than Treasuries b) Municipal bonds tend to have a lower rating than Treasuries c) Municipal bonds are "risk free" securities d) Municipal bonds are an interesting investment from a tax perspectivearrow_forward3. A pension fund has the following liability obligations to its pensioners: Market Value $4.25 Bln $5.75 Bln $3.50 Bln Liability A B C It has $13.50 Bln available cash to invest in the following bonds: Bond Ꭰ E Modified Duration Modified Duration 5.25 11.86 6.25 8.05 7.55 Set up the system of equations to determine how much of its available cash should the pension fund invest in the two bonds to ensure that the market value duration of assets will match the market value duration of liabilities.arrow_forward

- Which of the following statement is true? Interest rates on Municipal bonds are on average Question 24 options: lower than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as liquid as the U.S. government bonds . higher than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as risky as the U.S. government bonds . lower than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as risky as the U.S. government bonds . lower than those of the U.S. government bonds with the same terms to maturity because many local business prefers municipal bonds. higher than those of the U.S. government bonds with the same terms to maturity because municipal bonds are not as liquid as the U.S. government bonds .arrow_forward4. Chapter MC, Section .03, Problem 106 A 7-year municipal bond yields 4.80%. Your marginal tax rate (including state and federal taxes) is 32.00%. What interest rate on a 7-year corporate bond of equal risk would provide you with the same after-tax return? (Round your final answer to two decimal places.) Oa. 7.06% Ob. 3.64% OC. 6.34% d. 3.26% e. 15.00% Save & Continue Continue without savingarrow_forwardEf 505.arrow_forward

- Use excelarrow_forwardWhich of the following statements about are true about municipal bonds? (Select all that apply: 3 of the answers below are correct.) O Municipal bonds are typically backed by a pool of residential mortgages O Intrest payments dy municipal bonds are exempt from federal income täxes and most state & local income taxes O Municipal bonds can typically be exchanged for sstock in the underlying issuer at the discretion of the bond holder. O A municipal bond sold to finance a specific revenue-generting project and backed by cash flows from that project are called "Revenue Bonds". O A municipal bond backed by the full faith & credit of the issuer is called a "General Obligtion Bond". O There is NO secondary market for municipal bonds. O municipal bonds are generally considered to be low risk because they are insured by the FDICarrow_forwardIf a bond is backed by the revenue generated from a project, it is called______ Group of answer choices GO bond Revenue bond Green bond tax-supported bondarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education