Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

- A mother is thinking about funding her daughter’s medical education in 6 years when she is expected to enrol at UWI, St. Augustine. She opens a special savings account, where she can receive a lump sum in 6 years. If she is desirous of receiving $50,000 in 6 years when her daughter is matriculating, how much would you advise her to deposit in the savings account monthly if annual interest rate is 7%? Show all working.

Expert Solution

arrow_forward

Step 1

A concept through which it is studied that the current worth of money is higher than its future worth is term as the TVM (time value of money).

arrow_forward

Step 2

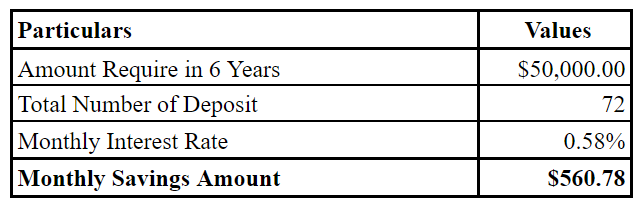

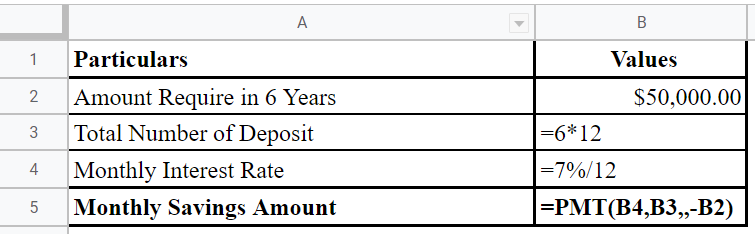

Computation of the monthly savings amount:

It is computed in the following manner:

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A) When Liam Corbett was born, his grandparents opened a 529 college savings plan for him so that he had enough money to pay for college once he turned 18. His college education is expected to cost $225,000 on the day he turns 18 years old. Determine if there will be enough in the account given the following assumptions (Show your calculations): Assumption #1: The grandparents contribute $6,200 per year starting the day Liam is born and the account earns an average annual rate of return of 7%. Assumption # 2: The grandparents contribute $5,000 per year starting the day Liam is born and the account earns an average annual rate of return of 7%. Assumption # 3: The grandparents contribute $5,000 per year starting the day Liam is born and the account earns an average annual rate of return of 9%. Assumption #4: The grandparents contribute $8,500 per year starting the day Liam is born and the account earns an average annual rate of return of 4%. Assumption # 5: The grandparents contribute…arrow_forwardTala McLouf, a 21-year-old BBA graduate, likes to plan for her future ahead, and would like to save $47.50 every week for her retirement later on. At the end of each year, Tala would invest her total accumulated savings into an account at the local credit union paying her a yearly interest rate of 8.25%. How much money will Tala be able to save per year? How much money will Tala have saved when she reaches 55 years old? How much would Tala have saved by the time she is 60 years old, if she starts investing for her retirement at the age of 40 after paying off the mortgage for her house in Los Angeles? Even if Tala starts saving at 40, she would still like to have the same amount of money in her account when she is 60 as she would have had, had she started saving back when she was 21.arrow_forwardA couple plans to save for their child's college education. What principal must be deposited by the parents when their child is born in order to have $42,000 when the child reaches the age of 18? Assume the money earns 5% interest, compounded monthly. (Round your answer to two decimal places.)arrow_forward

- Grandma Patt has decided to open a savings account for her newborn granddaughter. The savings account pays 3% interest. If Grandma Patt wants there to be $10,000 in the account in 18 years, how much should she deposit today? Assume no other deposits or withdrawals. a) $5,873.95 b) $17,024.33 c) $8,362.17 d) $10,609.23arrow_forwardA couple plans to save for their child’s college education. What principal must be deposited by the parents when their child is born in order to have$80,000 when the child reaches the age of 18? Assume the money earns 8% interest, compounded quarterly.arrow_forwardYour son Tommy was just born today (Year O), and you are planning for his college education. You would like to make equal deposits every 26 weeks (assume a 52-week year) into a college savings account starting in Year 1 and ending in Year 21 (a total of 41 deposits), so that Tommy can make annual withdrawals in Year 18, 19, 20, and 21 for tuition. Tuition is currently (Year 0) $2,900/year, and it is expected to grow at 4% / year for each of the next 10 years, and then at 5%/year for all years after. You can earn a nominal annual rate of 8.45%, with interest compounded weekly (52-week year) in a college savings account. How much must each of the 41 deposits be to exactly fund the expected tuition expense? O $277.87 O $264.49 O $258.02 O $248.10 O $287.80arrow_forward

- Suppose that you need $30,000 for your last year of college. You could go to a private lending institution and apply for a signature student loan; rates range from 7% to 14%. However, your Aunt Sally is willing to loan you the money from her retirement savings, with no repayment until after graduation. All she asks is that in the meantime you pay her each month the amount of interest that she would otherwise get on her savings (since she needs that to live on), which is 4%.What is your monthly payment to her, and how much interest will you pay her over the year (9 months)?(Fill in the blanks below and give your answers as whole numbers.)The amount of interest per month you would pay Aunt Sally is $__(1)__ .The total interest you will pay her over the year (9 months)is $__(2)__ .arrow_forwardyou have just won the lottery, and wish to ensure that will have $350,000 in 11 years to send your child to college. if your bank pays 4.46%, hours much must you deposit today to accumulate these funds?arrow_forwardHolly wants to have $220,000 to send a recently born child to college. She sets up a 529 plan and wants to know how much she must invest at the end of each year for the next 15 years if the funds can earn 4 percent. Use Appendix C to answer the question. Round your answer to the nearest dollar.$ If she can earn 5 percent, how much less will she have to invest each year? Use Appendix C to answer the question. Round your answer to the nearest dollar.$arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education