Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

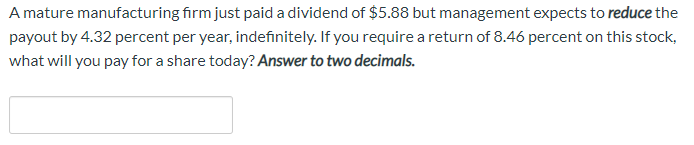

Transcribed Image Text:A mature manufacturing firm just paid a dividend of $588 but management expects to reduce the

payout by 4.32 percent per year, indefinitely. If you require a return of 8.46 percent on this stock,

what will you pay for a share today? Answer to two decimals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose instead that the company is about to pay a dividend of $2.00 per share. You also learn that the company is expected to have net income of $100 million, dividends of $50 million, and total equity of $1.5 billion (and that these relationships are expected to be stable). If the relevant required rate of return is 10%, what is the intrinsic value per share of the company’s stock?arrow_forwardPlease help with answers asap.arrow_forwardA young company currently does not pay a dividend. The company retains all its earnings to finance its growth. However, 10 years from now the company is expected to start paying a $1.50 dividend. According to analysts, the dividend should then grow by 5% annually forever. If the required return on the share investment is 15%, what should be the company's share price five years from today? a. $16.28 b. $8.57 c. $11.50 d. $6.24arrow_forward

- General Importers announced that it will pay a dividend of $3.65 per share one year from today. After that, the company expects a slowdown in its business and will not pay a dividend for the next 4 years. Then, 6 years from today, the company will begin paying an annual dividend of $1.75 forever. The required return is 11.4 percent. What is the price of the stock today? Multiple Choice O $3.28 $11.31 O $13.24 O $12.22 O $15.35arrow_forwardYou have just purchased a share of stock for $20.29.The company is expected to pay a dividend of $0.52 per share in exactly one year. If you want to earn a 9.1% return on your investment, what price do you need if you expect to sell the share immediately after it pays the dividend? The price one year from now should be $_______.(Round to the nearest cent.)arrow_forwardAntiques R Us is a mature manufacturing firm. The company just paid a dividend of $8, but management expects to reduce the payout by 6 percent per year indefinitely.If you require a return of 13 percent on this stock, what will you pay for a share today? choose the correct option: A. 39.58 B.39.97 C. 107.43 D. 42.11 E. 39.18arrow_forward

- 4) see picarrow_forwardSuppose a stock pays a dividend of $3 per share each year, and you don’t expect that dividend to change. Using the zero-growth model answer the following: (a) If you want a 10% return on your investment, how much should you be willing to pay for the stock? (b) The Fed cut the interest rate by 2%, causing the required investment return drop to 8%. What’s the value of a share of stock?arrow_forwardBarton Industries expects next year's annual dividend, D1, to be $2.30 and it expects dividends to grow at a constant rate g = 4.9%. The firm's current common stock price, P0, is $25.00. If it needs to issue new common stock, the firm will encounter a 4.5% flotation cost, F. What is the flotation cost adjustment that must be added to its cost of retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. _____% What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. _____%arrow_forward

- Franklin Corporation is expected to pay a dividend of $1.24 per share at the end of the year (D1 = $1.24). The stock sells for $32.40 per share, and its required rate of return is 7.2%. The dividend is expected to grow at some constant rate, g, forever. What is the equilibrium expected growth rate? (Round your answer to 2 decimal places.) Please work out the problem do not use excel.arrow_forwardThe RLX Company just paid a dividend of $2.60 per share on its stock. The dividends are expected to grow at a constant rate of 5.75 percent per year, indefinitely. Assume investors require a return of 12 percent on this stock. a. What is the current price? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What will the price be in four years and in sixteen years? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. a. Current price b. Price in four years Price in sixteen years $ 43.99arrow_forwardSuppose that you sell short 500 shares of Intel, currently selling for $40 per share. Your initial percentage margin is 60%. Assume you earn no interest on the funds in your margin account and Intel has paid no dividends. a. What will be your rate of return after one year if Intel stock is selling at $40? b. If the maintenance margin is 30%, how high can Intel's price rise before you get a margin call?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education