ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

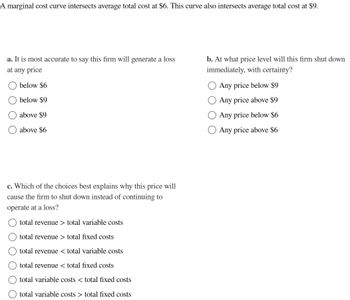

Transcribed Image Text:A marginal cost curve intersects average total cost at $6. This curve also intersects average total cost at $9.

a. It is most accurate to say this firm will generate a loss

at any price

below $6

below $9

above $9

above $6

c. Which of the choices best explains why this price will

cause the firm to shut down instead of continuing to

operate at a loss?

O O O O O

total revenue > total variable costs

total revenue > total fixed costs

total

revenue < total variable costs

total revenue < total fixed costs

total

variable costs < total fixed costs

total variable costs > total fixed costs

b. At what price level will this firm shut down

immediately, with certainty?

Any price below $9

Any price above $9

Any price below $6

Any price above $6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following costs of a typical firm in a purely competitive industry. The firm has no fixed costs (average total cost = average variable cost). Average Total Cost Quantity Marginal Cost 1 $28.00 2 20.50 $13.00 3 16.67 9.00 4 15.25 11.00 16.00 19.00 6 18.83 33.00 a. Given only the information available, what would you expect product price to be in the long run? O $11.00 O $19.00 O $16.00 O $15.25 b. What would you expect price to be in the short run? O $9.00 O $13.00 O $11.00 O $19.00arrow_forward(Figure 10-3)What is the maximum economic profit this firm depicted in Figure 10-3 will be able to earn? Group of answer choices $600 $200 $400 $0arrow_forwardAssume the following total cost schedule for a perfectly competitive firm. Output TVC (S) TFC ($) 100 1 40 100 2 70 100 3 120 100 180 100 250 100 6. 330 100 TABLE 9-1 Refer to Table 9-1. If the firm is producing at an output level of 6 units, the ATC is and the AVC is Select one: a. $71.67: $55 b. $38.33: $16.67 C $55: $16.67 d. $55: S80 e. $80: $55arrow_forward

- Price (S) AB UD A) $(60-C) × 3 Quantity B) $(60-D) x 2 OC) $(60-B) × 5 OD) $(60-B) × 4 O E) $(60 - A) × 5 MC ATC Refer to the figure above, which indicates the short-run cost data for a typical firm in a perfectly competitive industry. If the price faced by a perfectly competitive firm is equal to $60, then this firm will earn profits of......if it maximizes profits. p = $60 AVCarrow_forwardConsider the following figure for a perfectly competitive firm in the short run. Price, Costs MC ATC AVC 30 26 20 12 ------ 10 ..---- .---- 8 12 21 30 32 40 Output Suppose the industry price is $20. If the firm produces its profit-maximizing or loss-minimizing output, then it will make a equal to Loss; $420 Profit ; $240 Loss ; $180 Loss; $240arrow_forwardAnswer Question 6arrow_forward

- t of 35 45 40 30 25 255 15 20 10 5 MC, AC MC AC 9 0 100 200 300 400 500 The graph shows average and marginal cost curves for a typical firm in a perfectly competitive industry in LONG-RUN equilibrium. The long-run equilibrium price of the product is $ In long-run equilibrium the firm will produce units. In long-run equilibrium the firm will earn $ economic profit.arrow_forwardMC Price AC £/unit AVC D2 D3 D1 D4 Quantity/ week Figure 9 Cost curves for a price-taker firm Figure 9 shows a price-taker firm, with average cost AC, average variable cost AVC, and marginal cost MC curves. Select the demand curve shown on Figure 9 to represent a firm making only normal profit. Select one: D3 D4 O D2 O D1arrow_forwardThe figure given below shows the revenue and cost curves of a perfectly competitive firm. Figure 10.2 Price 50 35 30 20 10 $450 $700 10 $500 15 MC 20 MR AVC Refer to Figure 10.2. Compute the profit earned by the firm at the profit-maximizing level of output. $300 ATC Quantityarrow_forward

- Nonearrow_forwardRefer to the diagram to the right which shows the cost and demand curves for a profit-maximizing firm in a perfectly competitive market. What is the amount of its total fixed cost? OA. $1,000 B. $1,440 OC. $2,520 OD. It cannot be determined. Price and cost (5) 40.50 36.00 30.00 28.00 130 180 Quantity MC 240 ATC AVC MRarrow_forwardIn the above figure, the perfectly competitive firm's shutdown point is at a price ofarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education