Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

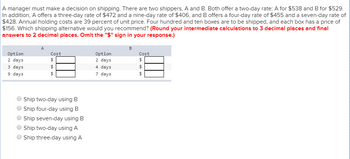

Transcribed Image Text:A manager must make a decision on shipping. There are two shippers, A and B. Both offer a two-day rate: A for $538 and B for $529.

In addition, A offers a three-day rate of $472 and a nine-day rate of $406, and B offers a four-day rate of $455 and a seven-day rate of

$428. Annual holding costs are 39 percent of unit price. Four hundred and ten boxes are to be shipped, and each box has a price of

$156. Which shipping alternative would you recommend? (Round your intermediate calculations to 3 decimal places and final

answers to 2 decimal places. Omit the "$" sign in your response.)

Option

2 days

3 days

9 days

Cost

$

69 69 69

$

Ship two-day using B

Ship four-day using B

Ship seven-day using B

Ship two-day using A

Ship three-day using A

Option

2 days

4

days

7

days

B

Cost

$

69 69 69

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Your options for shipping $96,970 of machine parts from Baltimore to Kuala Lumpur, Malaysia, are (1) use a ship that will take 32 days at a cost of $3,370, or (2) truck the parts to Los Angeles and then ship at a total cost of $5,180. The second option will take only 20 days. You are paid via a letter of credit the day the parts arrive. Your holding cost is estimated at 30% of the value per year. If you have a third option and it costs only $4,440 and also takes 20 days, what is your most economical plan? The daily holding cost of Alternative 1 is $ 79.70 . (Enter your response rounded to two decimal places.) The daily cost of faster shipping with Alternative 2 is $ 150.83. (Enter your response rounded to two decimal places.) The daily cost of faster shipping with Alternative 3 is $ (Enter your response rounded to two decimal places.)arrow_forwardDetermine which delivery alternative would be most economical for 70 boxes of parts. Each box costs $346 and the annual holding cost is 30% of the cost. Assume 365 days per year. Overnight delivery option costs $300, and eight-day delivery option costs $125 a. The overnight option is at least $70 cheaper than eight-day b. The eight-day option is at least $35 cheaper than overnight c. The eight-day option is at least $70 cheaper than overnight d. The overnight option is at least $35 cheaper than eight-dayarrow_forwardAsaparrow_forward

- Your options for shipping $104,800 of machine parts from Baltimore to Kuala Lumpur, Malaysia, are (1) use a ship that will take 30 days at a cost of $3,370, or (2) truck the parts to Los Angeles and then ship at a total cost of $5,030. The second option will take only 18 days. You are paid via a letter of credit the day the parts arrive. Your holding cost is estimated at 30% of the value per year. If you have a third option and it costs only $4,080 and also takes 18 days, what is your most economical plan? Part 2 The daily holding cost of Alternative 1 is $________. (Enter your response rounded to two decimal places.) Part 3 The daily cost of faster shipping with Alternative 2 is $________. (Enter your response rounded to two decimal places.) Part 4 The daily cost of faster shipping with Alternative 3 is $________. (Enter your response rounded to two decimal places.) Part 5 ▼ Alternative 1? Alternative 2? Alternative 3? is more economical.arrow_forwardA retailer has two stores selling the same product. Weekly demand at store 1 is normally distributed with a mean of 100 and a standard deviation of 10, while weekly demand at store 2 is normally distributed with a mean of 150 and a standard deviation of 25. Demand at the two stores is independent. The retailer orders from a supplier with a 1 week lead time using a periodic review policy with a review period of 1 week, and targets a 95% service level. If the retailer wants to centralize inventory across the two stores, i.e., hold just one stock of inventory to serve demand from both stores, what should the order-up-to level be? PLEASE SHOW CALCULATIONarrow_forwardA manager must make a decision on delivery alternatives. There are two carriers, A and B. Both offer a two-day rate. In addition, A offers a three-day rate and a nine-day rate, and B offers a four-day rate and a seven-day rate. Three hundred boxes are to be delivered and the freight cost for the whole lot for each option is given below. Annual holding cost is 35 percent of unit cost, and each box has a cost of $130. Assume 365 days per year. Which delivery alternative would you recommend? Carrier A Options 2 days 3 days 9 days Carrier A Carrier B Freight Cost $580 520 480 Carrier B Options 2 days 4 days 7 days Freight Cost $570 540 500 Delivery alternative ✓Click to select) D Two-day Three-day Nine-dayarrow_forward

- Consider a two-tier supply chain with one manufacturer and one retailer whointeract in a single selling season. The manufacturer sells a product to the retailer, who in turn sells in the market. Demand E is uncertain with cumulative distribution function F (·)and probability density function f (·). Since the production lead time is much longer thanthe selling season, the retailer must place a single order before demand is realized and cannotreplenish her inventory during the season. The retailer sells the product at an exogenousand fixed retail price r. The manufacturer produces the product at a unit cost of c. Themanufacturer uses a linear sales rebate contract and determines the following contract terms:For each unit ordered, he charges the retailer a wholesale price w, and for each unit sold, hepays the retailer a rebate s. Assume that the product has zero salvage value at the end ofthe season, and the inventory holding cost during the season is…arrow_forwardYou are a purchasing manager in charge of stocking a certain type of product. Weekly demand for these products is normally distributed, with a mean of 100 and a standard deviation of 50. Holding costs are 25%, and you must hold a level of inventory corresponding to a cycle service level of 95%. You are faced with two suppliers, QUALITY Products and BEST Products, who offer the following terms. QUALITY sells the products for €5,000 with a minimum order of 100, and a lead time of 1 week with a standard deviation of 0.1 week. BEST sells the transformer for €4,800, has a minimum batch of 1,000, a lead time of 5 weeks, and a lead-time standard deviation of 4 weeks. If you could use both suppliers, how would you structure your orders? Describe the dimensions of supplier performance that affect total costarrow_forwardA manufacturing plant procures 100,000 filters per year. Each unit has a fixed order cost is $50. To maintain the inventory in optimal conditions, there is a carrying cost rate of 10% per year. The vendor of filters has offered the following price breaks: for orders of more than 5,000 filters, cost is $4.50/unit; for orders between 1,000 and 5,000 filters, cost is $4.75/unit; orders less than 1,000 filters have a cost of $5.00/unit. Find the economic order quantity. Calculate the average annual cost for the optimal solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.