Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

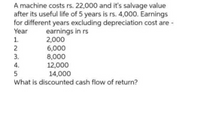

Transcribed Image Text:A machine costs rs. 22,000 and it's salvage value

after its useful life of 5 years is rs. 4,000. Earnings

for different years excluding depreciation cost are -

earnings in rs

2,000

6,000

8,000

12,000

Year

1.

2

3.

4.

5

14,000

What is discounted cash flow of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Myca Corporation has a project with the following cash flows. What is the value of the cash flows today assuming an annual interest rate of 10.6 percent? Year Cash Flow 1 $ 1,940 2 2,480 3 2,850 4 2,860arrow_forwardC. Suppose that the initial cost of a certain operation is $25000 at the beginning of the first year. The expenditures are expected to be ($1500) at the end of the first year, $1000 at the end of second year, and to increase by $500 at the end of each of the next 4 years. The salvage value at the end of the 8th year is $1500. Draw the cash flow diagram.arrow_forwardD. Cómpute the Pay-back period for a project that costs Sh.80,000 and yields the following cash flows for 5 years. Year 1 3 4. 5. Cash flows 10,000 30,000 15,000 20,000 30,000arrow_forward

- Compute the annual-equivalence amount for the following cash flow series at i = 12% $1.600 S1.600 $800 SH00 S800 $500 $500 $1.000 You invest in a piece of equipment costing $50,000. The equipment will be used for two years, and it will be worth $20,000 at the end of three years. The machine will be used for 4,000 hours during the first year, 6,000 hours during the second year, and 5,000 hours during the third year. The expected savings associated with the use of the piece of equipment will be $28,000 during the first year, $40,000 during the second year, and $35,000 during the third year. Your interest rate is 12%. (a) What is the capital recovery cost? (b) What is the annual equivalent worth? (c) What is net savings generated per machine-hour?arrow_forwardA project has the following cash in and out flows in its first year: Income generated: R100 000 Cost of sales R30 000 Depreciation R10 000 What would the tax payable for the first year of the project be if the tax rate is 27%?arrow_forwardRed Zone Corporation recently purchased a new machine for $339,0 13.20. The new equipment has a useful life of 10 years. Net cash flows will be $60,000 per year, end of year payments. What is the internal rate of return? Question 1Select one: a. 12 percent b. 16 percent c. 14 percent d. 10 percent e. 18 percentarrow_forward

- The cash flow after taxes for two machineries A and B are given in the table below.Year wise Cash flow A B1 22000 70002 25000 50003 28000 45004 5000 280005 4500 250006 7000 22000The estimated useful life of the machines is 6 years and the discount rate is 11%. The cost of each machine is Rs60000 1. Discuss the steps of application of the concept of NPV to the given situation. Determine the NPV of Machine A . 2. Determine the NPV of the Machine B. Discuss, which machinery should be acquired and why?arrow_forwardThe salvage value of an asset is RM75,000. The annual cash flow is RM 10,500, and the networking capital is RM4,800. If the tax rate is 28%, what is the terminal cash flow of the asset?arrow_forwardWhat will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8, 200 per year for 5 years. Assume that the new machine cost $ 42,000 and will depreciate on a straight line basis over the 5 years and that Mimi has a tax rate of 32 percent. Question 15Select one: a. - $5,576 b. $42,000 C. -$8,264 d. $33,800 e. - $2,688arrow_forward

- The cash flows in year-1, year-2, year-3, and year-0 are $4,000, $3,000, $5,000, and - $8,000. Compute the discounted payback period if the required rate of return is 10%. Between 2-3 years 2.50-years 2.20-years None of the above а. b. с. d.arrow_forwardIf the cost of the truck is OMR 30,000 and the annual depreciation expense OMR 2,000. How much will be the book value of the truck at the year end? a. OMR 32,000 b. OMR 30,000 c. OMR 2,000 d. OMR 28,000arrow_forwardThis question is based on the following in formation: An investment is Machinery costing P 250,000 with a 4-year life and no salvage value is expected to produce the following net income after taxes of 30%: End of year 1 P 17,000 2 22,000 3 25,000 4 26,000 How much is the annual tax shield?How much is the annual tax shield?A. P 17,580B. P 17,850C. P 18,570D. P 18,750What is the ROI (using the cash income)? A. 6.3%B. 9%C. 31.3%D. 34%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education