Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

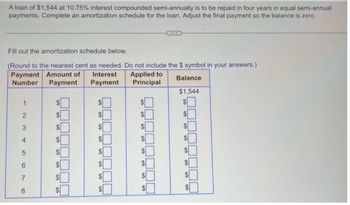

Transcribed Image Text:A loan of $1,544 at 10.75% interest compounded semi-annually is to be repaid in four years in equal semi-annual payments. Complete an amortization schedule for the loan. Adjust the final payment so the balance is zero.

---

Fill out the amortization schedule below.

(Round to the nearest cent as needed. Do not include the $ symbol in your answers.)

| Payment Number | Amount of Payment | Interest Payment | Applied to Principal | Balance |

|----------------|-------------------|------------------|---------------------|---------|

| 1 | $ | $ | $ | $1,544 |

| 2 | $ | $ | $ | $ |

| 3 | $ | $ | $ | $ |

| 4 | $ | $ | $ | $ |

| 5 | $ | $ | $ | $ |

| 6 | $ | $ | $ | $ |

| 7 | $ | $ | $ | $ |

| 8 | $ | $ | $ | $ |

Expert Solution

arrow_forward

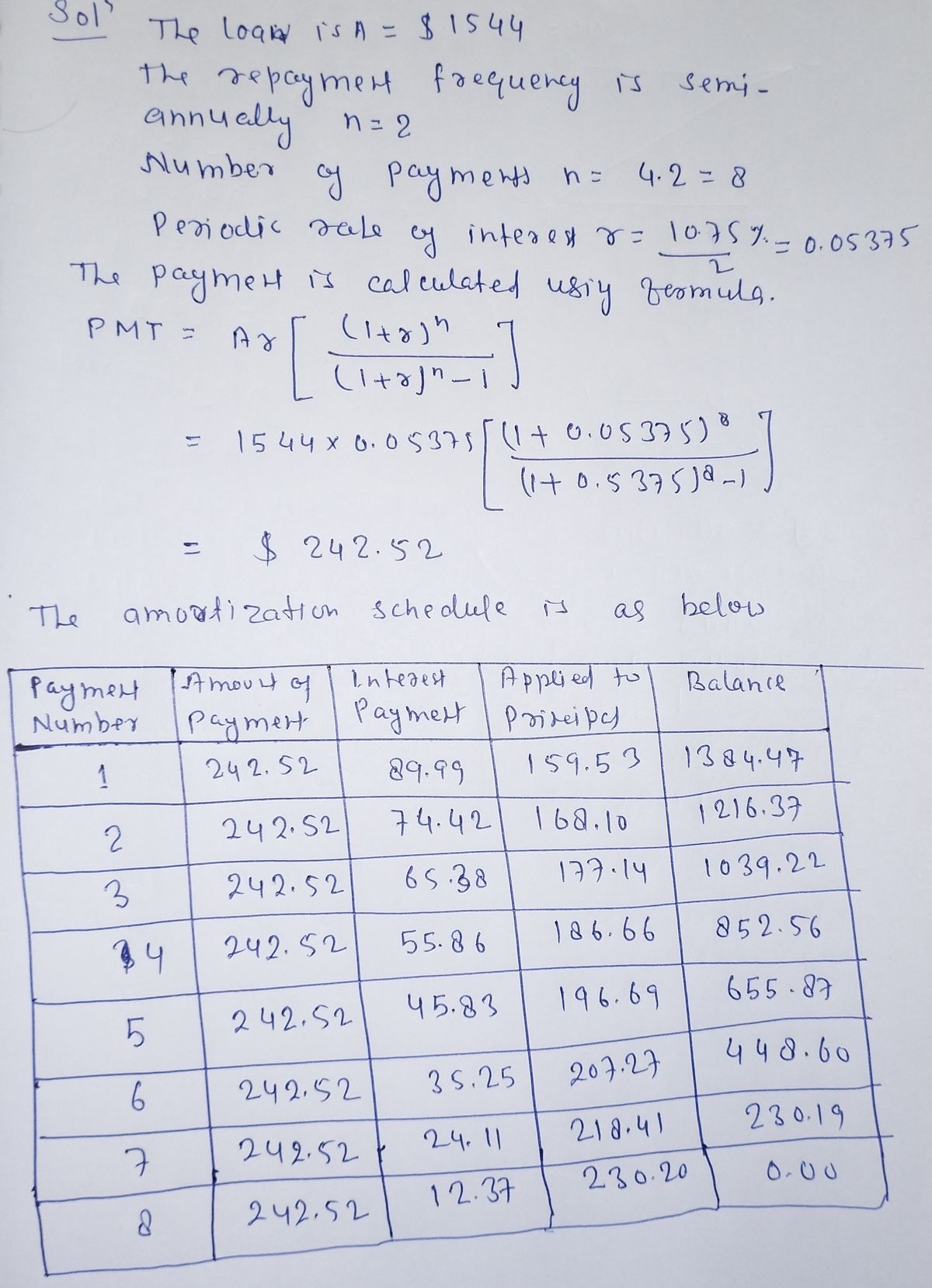

Step 1

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Liv buys a new car. Her auto loan is $18,000 with an annual interest rate of 3.6% compounded monthly for 5 years. Her monthly payment is $328.26. The following table shows the first payment in the amortization schedule. Payment Number Loan Amount Payment Interest Principal Remaining Balance 1 $18,000.00 $328.26 ? ? How much of Liv's first payment is distributed to interest and to principal? Select the correct value for each. principal interest :: $54.00 :: $328.26 :: $274.26 :: $11.81 :: $316.45arrow_forwardConsider a 20-year mortgage for $194,811 at an annual interest rate of 5.3%. After 8 years, the mortgage is refinanced to an annual interest rate of 2.5%. What are the monthly payments after refinancing? Round your answer to the nearest dollar.arrow_forwardUse PMT = . Round to the nearest dollar. Suppose that you borrow $10,000 for four years at 7% toward the purchase of a car. Find the monthly payments and the total interest for the loan. A.$281; $13,488 B.$239; $1472 C.$624; $19,952 D.$239; $11,472arrow_forward

- Compute the monthly payments for the add on interest loan. The amount of the loan is $9,011.28. The annual interest rate is 4.4%. The term of the loan is 0.5 years.arrow_forwardCalculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answer to the nearest cent.) $375 balance, 18%, $325 payment; average daily balance methodarrow_forwardFind the monthly payment of the loan. Purchase Price Down Payment Finance Charge #of Monthly Payments $2700 $500 $250 36 What is the monthly payment?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,