Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

USING FORMULAS, NO TABLES, CORRECT ANSWERS ARE FOR 1. N = 20 QUARTERS (5 YEARS REMAINING) AND FOR 2. X = £206.78

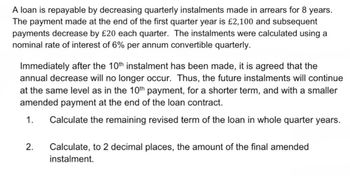

Transcribed Image Text:A loan is repayable by decreasing quarterly instalments made in arrears for 8 years.

The payment made at the end of the first quarter year is £2,100 and subsequent

payments decrease by £20 each quarter. The instalments were calculated using a

nominal rate of interest of 6% per annum convertible quarterly.

Immediately after the 10th instalment has been made, it is agreed that the

annual decrease will no longer occur. Thus, the future instalments will continue

at the same level as in the 10th payment, for a shorter term, and with a smaller

amended payment at the end of the loan contract.

1. Calculate the remaining revised term of the loan in whole quarter years.

2. Calculate, to 2 decimal places, the amount of the final amended

instalment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- solution in excelarrow_forwardWhat amount of money invested today at 3.54% compounded monthly will have an accumulated value of $452,000 in 6 years from now. Round all answers to two decimal places if necessary. A P/Y = C/Y = N = I/Y = PMT = $ FV = $ PV = $arrow_forwardI dont need handwritten at all.. pls help correctlyarrow_forward

- PLEASE, WRITE THE SOLUTIONS ON PAPER, EXPLAINING THE ENTIRE PROCESS, THE ONLY POSSIBLE SOLUTIONS ARE THE STIPULATED ONESarrow_forwardPlease answer part dd and ee of C, strictly follow the formula.arrow_forwardSolve for the unknown interest rate in each of the following: (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value $ 290 410 44,000 43,261 Years 3 18 20 Interest Rate % % % % Future Value $ 345 1,253 209,290 388,485arrow_forward

- Complete the table by finding the balance A when $18,000 is invested at rate r for t years, compounded continuously. (Round your answers to two decimal places.) r = 8% t 10 20 30 40 50 A $ $ $ $ $arrow_forward3. * The force of interest (t) at time t (measured in years) is a + bt² where a and b are constants. An amount of £200 at time t = 0 accumulates to £210 at t = 5 and £230 at t = 10. 1 (a) Show that a = log (1.05) - 30 log(1.15) = 0.008352, and b = 250 log(1.15) - 125 log(1.05) = 0.0001687. (b) Compute A(0, 7) and hence compute the discounted value at t = 0 of a payment of £750 due at t = 7. (c) Compute A(6, 7). What is the equivalent constant annual interest rate for the year from t = 6 to t = 7? (d) Calculate the constant force of interest that would give rise to the same accumulation from t = 0 to t = 10.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education