A First Course in Probability (10th Edition)

10th Edition

ISBN: 9780134753119

Author: Sheldon Ross

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

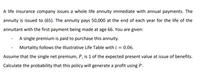

Transcribed Image Text:A life insurance company issues a whole life annuity immediate with annual payments. The

annuity is issued to (65). The annuity pays 50,000 at the end of each year for the life of the

annuitant with the first payment being made at age 66. You are given:

A single premium is paid to purchase this annuity.

Mortality follows the Illustrative Life Table with i = 0.06.

%3D

Assume that the single net premium, P, is 1 of the expected present value at issue of benefits.

Calculate the probability that this policy will generate a profit using P.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Similar questions

- The principal P is borrowed at a simple interest rate r for a period of time t. Find the loans future value A, or the total amount due ay time t. P= $7000 , r= 4.0%, t= 4 monthsarrow_forwardThe principal P is borrowed at simple interest rate r for a period of time t. Find the loan's future value, A, or the total amount due at time t. Round answer to the nearest cent. P = $700, r = 8.25%, t = 3 months %3D (Round to the nearest cent as needed.) $719.44 $714.44 $715.75 $873.25arrow_forwardA student loan allows you to borrow now, and pay after you graduate. Consider a loan with a 7% annual percentage rate. No payments are due until after you graduate, but interest accrues (i.e. is added to the balance) monthly. Suppose you borrow $25,000 now. How much will you owe (including interest) at the end of 4 years? Show your work by creating a table with interest accrued each period.arrow_forward

- The simple interest owed for the use of the money is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardFind the amount of periodic payment necessary for the deposit to a sinking fund. (Round your answer to the nearest cent.)$ Amount Needed A Frequency n Rate r Time t $70,000 semiannually 3% 10 yrarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)ProbabilityISBN:9780134753119Author:Sheldon RossPublisher:PEARSON

A First Course in Probability (10th Edition)

Probability

ISBN:9780134753119

Author:Sheldon Ross

Publisher:PEARSON