Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

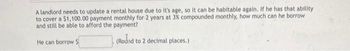

Transcribed Image Text:A landlord needs to update a rental house due to it's age, so it can be habitable again. If he has that ability

to cover a $1,100.00 payment monthly for 2 years at 3% compounded monthly, how much can he borrow

and still be able to afford the payment?

He can borrow $

(Round to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your friend tells you he has a very simple trick for taking one-third off the time it takes to repay your mortgage: Use your Christmas bonus to make an extra payment on January 1 of each year ( that is, pay your monthly payment due on that day twice). If you take out your mortgage on July 1, so your first monthly payment is due August 1, and you make an extra payment every January 1, how long (in years) will it take to pay off he mortgage? Assume that the mortgage has an original term of 30 years and an APR of 10.2%. (Hint: The original balance does not matter in this problem, so you can pick any number you want. In this case we will use $100,000 as the principal balance.) Round to three decimal places.arrow_forwardKerri James is considering the purchase of a car, which will cost her $24,600. She will borrow the entire purchase price and make monthly payments over the next six years. The first payment is due next month and the annual interest rate is 3.00%. She will owe $____ on the car immediately following the 18th payment. A. 18,858.19 B. 18,531.57 C. 20,757.33 D. 19,184.00 E. 23,258.56arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward

- After graduation, you plan to work for Asia Corporation for 12 years and then start your own business. You expect to save and deposit Php7,500 a year for the first 6 years (n = 1 through n = 6) and Php15,000 annually for the following 6 years (n = 7 through n = 12). The first deposit will be made a year from today. In addition, your grandfather just gave you a Php25,000 graduation gift which you will deposit immediately (n = 0). If the account earns 8% compounded annually, how much will you have when you start your business 12 years from now? A.Php228,145 B. Php250,712 C. Php260,302 D. Php263,907 E. Php277,797arrow_forwardA couple buys a $180000 home, making a down payment of 20%. The couple finances the purchase with a 15 year mortgage at an annual rate of 3.8%. Find the monthly payment. If the couple decides to increase the monthly payment to $1100, find the number of payments.arrow_forwardTodd is able to pay $360 a month for 6 years to finance a car purchase. a. If the interest rate is 6 percent compounded monthly, how much can Todd afford to borrow to buy a car? b. What is the effective annual rate of Todd's loan?arrow_forward

- A couple wants to purchase a new house and feel that they can afford a mortgage payment of $600 a month. They are able to obtain a 30-year 7.4% mortgage (compounded monthly) but must put down 20% of the cost of the house. Assuming that they have enough savings for the down payment, how expensive a house can they afford? The couple can afford a house that costs up to $ ☐ . (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardYour friend is currently paying $734 in rent monthly in Fort Wayne and would rather apply the payment toward purchasing a home. If she can get a 30 year mortgage at 4.67% APR using her current payment amount, how much could she borrow? What could you type into Excel to calculate this value?arrow_forwardAn acquaintance asks Kara to borrow money today to help her repair her car. The person will be able to repay Kara $500 in one year, and Kara is fully expects she will be repaid on time (risk free). If Kara requires a 5.0% return, what (largest) amount should she lend to her acquaintance?$525.00$495.00$475.00$476.19$471.43arrow_forward

- I need the answer of the question attached. Please provide all possible answers. Thank you!arrow_forwardDavid is planning to buy a new car. Since David has not save any money, he plans to take out a loan to pay for the car. He is able to finance $43,950 with a 5 year loan. The loan has a APR of 3.25% compounded monthly. Round answers to two decimal places a. What is the minimum payment amount David will need to make for his car loan? b.How much will David pay altogether over the life of his car loan?arrow_forwardAngela Montery has a five-year car loan for a Jeep Wrangler at an annual interest rate of 5.7% and a monthly payment of $595.50. After 3 years, Angela decides to purchase a new car. What is the payoff on Angela's loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education