FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

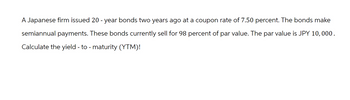

Transcribed Image Text:A Japanese firm issued 20 - year bonds two years ago at a coupon rate of 7.50 percent. The bonds make

semiannual payments. These bonds currently sell for 98 percent of par value. The par value is JPY 10,000.

Calculate the yield - to - maturity (YTM)!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- A major manufacturer is reevaluating its bonds since it is planning to issue a new bond in the current market. The firm's outstanding bond issue has 7 years remaining till maturity. The bonds were issued with an 8 percent coupon rate (paid quarterly) and selling at par value. The required rate of return is 10 percent. What is the current value of these securities?arrow_forwardBonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon US Treasury note with three years to maturity has a coupon rate of 6%. The yield to maturity (YTM) of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $567,545.29 $765,735.71 $900,865.54 $1,081,038.65 Based on your calculations and understanding of semiannual coupon bonds, complete the following statement: Assuming that interest rates remain constant, the T-note’s price is expected to ( Increase, Decrease).arrow_forwardA Japanese company has a bond outstanding that sells for 87 percent of its ¥100,000par value. The bond has a coupon rate of 5.4 percent paid annually and matures in21 years. What is the yield to maturity of this bond?arrow_forward

- Your firm has a credit rating of A. You notice that the credit spread for five-year maturity A debt is 89 basis points (0.89%). Your firm's five-year has semi-annual coupons and a coupon rate of 6%. You see that new five-year Government of Canada bonds are being issued with a YTM of 3%. What should the price of your outstanding five-year bonds be? Assume a par value of $100. The price of your outstanding five-year bonds should be $ (Round to the nearest cent.)arrow_forwardRaghubhaiarrow_forwardNikularrow_forward

- 3. The U.S. Government has a 20-year bond that matures 20 years from now and has a face value of $1,000. The bond has a coupon rate of 3.1% per year, paid semiannually. The yield on the bond is 8%. If coupons are reinvested at 3.6% per annum, then how much interest is earned on reinvested coupons over the life of the bond? Calculate the interest as a percentage of the total cash flows received by the bondholder. What is the amount of interest earned on reinvesting the coupons? $ (Round to the nearest cent.) What percentage of the total cash flows received by the bondholder is the interest earned on the reinvested coupons? % (Round to two decimal places.)arrow_forwardEven though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of €1,000, 10 years to maturity, and a coupon rate of 8.7 percent paid annually. If the YTM is 10.7 percent, what is the current bond price in euros? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Current bond pricearrow_forwardNew Hampshire Corp. has decided to issue three-year bonds denominated in 10 million Chinese yuan at par. The bonds have a coupon rate of 14 percent. If the yuan is expected to appreciate from its current level of $0.15 to $0.156, $0.164, and $0.173 in years 1, 2, and 3, respectively, what is the financing cost of these bonds?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education