Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

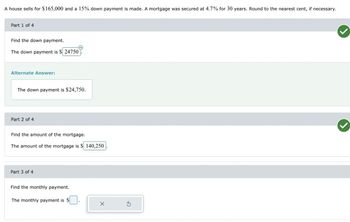

Transcribed Image Text:### Mortgage Calculation Example

A house sells for $165,000 and a 15% down payment is made. A mortgage was secured at 4.7% for 30 years. Round to the nearest cent, if necessary.

#### Part 1 of 4

**Find the down payment.**

- **The down payment is $24,750.**

#### Part 2 of 4

**Find the amount of the mortgage.**

- **The amount of the mortgage is $140,250.**

#### Part 3 of 4

**Find the monthly payment.**

- The monthly payment field is not filled in for this example.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- For a three year bond of $2,400 at a simple interest rate of 11% per year, find the semiannual interest payment and the total interest earned over the life of the bond. The semiannual interest on the bond is $. (Simplify your answer. Type an integer or a decimal. Round to the nearest cent as needed.) The total interest on the bond is $ (Simplify your answer. Type an integer or a decimal. Round to the nearest cent as needed.)arrow_forwardSuppose you obtain a 20-year mortgage loan of $192,000 at an annual interest rate of 7.9%. The annual property tax bill is $973 and the annual fire insurance premium is $498. Find the total monthly payment for the mortgage, property tax, and fire insurance. (Round your answer to the nearest cent.)$ _____arrow_forwardFind the monthly payment for the loan. (Round your answer to the nearest cent.) A $256,000 condominium bought with a 30% down payment and the balance financed for 30 years at 3.05%arrow_forward

- The amount to be financed on a new car is $9,500. The terms are 6% for 4 years. What is the monthly payment? Answer the question. (Round your answer to the nearest cent.)$ =arrow_forwardA house sells for $165,000 and a 15% down payment is made. A mortgage was secured at 4.7% for 30 years. Round to the nearest cent, if necessary. Part 1 of 4 Find the down payment. The down payment is $24750 Alternate Answer: The down payment is $24,750. Part: 1 / 4 Part 2 of 4 Find the amount of the mortgage. The amount of the mortgage is $ narrow_forwardA woman uses a loan program for small businesses to obtain a loan to help expand her vending machine business. The woman borrows $25,000 for 2 years with a simple interest rate of 1.8%. Determine the amount of money the woman must repay after 2 years. The woman must repay Sarrow_forward

- A couple buys a $180000 home, making a down payment of 20%. The couple finances the purchase with a 15 year mortgage at an annual rate of 2.66%. Find the monthly payment.$ If the couple decides to increase the monthly payment to $1000, find the number of paymentsarrow_forwardA couple buys a $150000 home, making a down payment of 17%. The couple finances the purchase with a 15 year mortgage at an annual rate of 2.99%. Find the monthly payment.$ If the couple decides to increase the monthly payment to $900, find the number of payments.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,