Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Hi sir please help me stepwise and dont do handwritten, also explain concept please or skip ill definitely like the answer. Just dont do on page (no handwritten)..

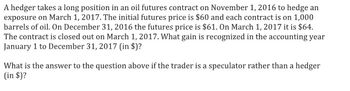

Transcribed Image Text:A hedger takes a long position in an oil futures contract on November 1, 2016 to hedge an

exposure on March 1, 2017. The initial futures price is $60 and each contract is on 1,000

barrels of oil. On December 31, 2016 the futures price is $61. On March 1, 2017 it is $64.

The contract is closed out on March 1, 2017. What gain is recognized in the accounting year

January 1 to December 31, 2017 (in $)?

What is the answer to the question above if the trader is a speculator rather than a hedger

(in $)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Can you send another picture or write it down cuz i dont understandarrow_forwardThe 3rd question is a Journal entry if this information..I can’t attach a photo unfortunately the website won’t let me, but I’ve attempted my best and am unable to show it. Any help would be appreciated! Thanks!arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- Your answers are incorrect, there are at least 4 blanks to fill in and you only provided 2 or 3. Also please do not use Excel, please use another way to show your work.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- BOR Tutor - Solution Page 1 of 1 | Ha X A learn.hawkeslearning.com/Portal/Lesson/lesson_certify#! MSC SSO Login To Do Assignments. E Reading list E Apps BSA Violation Civil... Search FAQS for Indian Trib... CPAJ The Past, Present, a... CPAJ Fraud in a World of... You were asked to answer the following question: Consider a small photography studio with 8 workers and 5 printers. The total cost of labor and capital is $3,300. In order to reduce total operating costs, the owner leases 5 additional printers and fires 5 workers. After these changes, the salary of each worker increases by $30, the cost of using each of the printers (both new and old) remains constant, and the total cost of labor and capital decreases to $2,950. What is the cost of using one printer? The following answer is correct: First, calculate the new total quantities of workers and printers after the changes were made. New quantity of workers= 8-5= 3 workers New quantity of printers = 5 + 5 = 10 printers Assume that C,…arrow_forward合日 Document1 Q. Search in Document Home Insert Draw Design Layout References Mailings Review View + Share a A. A- E -E - E , E E Times New R... - AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe AaBbCcDdEe AaBbCcDdEe AgBbCcDdEe AgBbCcDdEe Paste в I U - abe X, x2 Normal Heading 1 Subtle Emph.. Emphasis Styles Pane No Spacing Heading 2 Title Subtitle You are considering opening your own restaurant. To do so, you will have to quit your current job, which pays $46k per year, and cash in your life savings of $200k, which have been in a certificate of deposit paying 6% per year. You will need this $200k to purchase equipment for your restaurant operations. You estimate that you will have to spend $4k during the year to maintain the equipment so as to preserve its market value at $200k. Fortunately, you own a building suitable for the restaurant. You currently rent out this building on a month-by-month basis for $2,500 per month. You anticipate that you will spend $50k for food, $40k for extra help, and…arrow_forwardin text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forward

- List Paragraph For the... badiya aldujaili BA AutoSave ff Search EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut - A^ A° Aav A E - E - E E E O Find - Calibri (Body) 11 AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 5 6. 7 If Busby Corporation's variable cost ratio is 0.75, targeted after tax net income is $27,580 (tax rate of 20%), and targeted sales volume in dollars is $219,000 then Busby's total fixed costs are: a. $27,170 b. $71,380 c. $20,275 d. $136,670 e. $129,775 f. $26,350 g. $54,750 Page 3 of 3 331 words English (United States) Focusם 160% 8:28 PM O Type here to search ENG 2/11/2021 (凸) . I . I ..?. . . E • . . L. . . t .. I ..arrow_forwardPlease solve in Excel with explanation computation for each steps answer in text formarrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education