Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

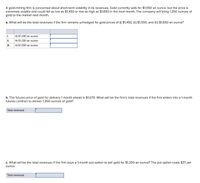

Transcribed Image Text:A gold-mining firm is concerned about short-term volatility in its revenues. Gold currently sells for $1,550 an ounce, but the price is

extremely volatile and could fall as low as $1,450 or rise as high as $1,650 in the next month. The company will bring 1,350 ounces of

gold to the market next month.

a. What will be the total revenues if the firm remains unhedged for gold prices of (i) $1,450, (ii) $1,550, and (iii) $1,650 an ounce?

i.

At $1,450 an ounce

i.

At $1,550 an ounce

iii.

At $1,650 an ounce

b. The futures price of gold for delivery 1 month ahead is $1,570. What will be the firm's total revenues if the firm enters into a 1-month

futures contract to deliver 1,350 ounces of gold?

Total revenues

c. What will be the total revenues if the firm buys a 1-month put option to sell gold for $1,350 an ounce? The put option costs $37 per

ounce.

Total revenues

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please don't give image based answer ..thankuarrow_forwardWhen you logged on to your brokerage account this morning, you saw that the Brazil Real is trading at 50.2970. Gold is trading at $200 per ounce. You have $10,000 to invest, and you think you might be able to make arbitrage profits in the gold market. How many Reals could you buy at the posted price? How much gold could you buy at the dollar price in the gold market? What would the gold be worth if the Real price is 750 BRL per ounce? If the Real price for gold is 750 BRL per ounce, how would you make arbitrage profits? How much would you make with your $10,000 investment?arrow_forwardNonearrow_forward

- Maxwell Mining Company's ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 8% per year. If Do $5 and rs = 17%, what is the value of Maxwell Mining's stock? Round your answer to the nearest cent. $arrow_forwardNonearrow_forwardKale Inc. forecasts the free cash flows (in millions) shown below. Assume the firm has zero non-operating assets. If the weighted average cost of capital is 11.0% and FCF is expected to grow at a rate of 5.0% after Year 2, then what is the firm’s total corporate value (in millions)? Do not round intermediate calculations. Year 1 2 Free Cash flow -$30 $195 a. $3,413 million b. $2,901 million c. $3,044 million d. $2,743 million e. $2,643 millionarrow_forward

- Maxwell Mining Company's ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 9% per year. If D0 = $5 and rs = 14%, what is the value of Maxwell Mining's stock? Round your answer to the nearest cent.arrow_forwardA small company owns an oil well. Initially revenues and dividends are expected to grow while the oilwell is being developed. It is then expected to slowly decline as it dries up until it shuts down.An annual dividend of $1.80 has just been paid. Dividends are expected to grow by 15% p.a. until t=6.Dividends are then expected to decline by 1.5% p.a. until t=25 when the well is expected to shut down.a. What is the dividend expected to be in 12 year’s time? b. What is the share price today if the shares are priced at 11.5% p.a.?arrow_forwardMaxwell Mining Company's ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 3% per year. If D0 = $3 and rs = 13%, what is the value of Maxwell Mining's stock? Round your answer to the nearest cent. $ ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education