Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help

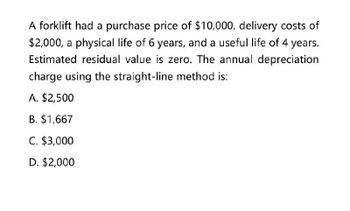

Transcribed Image Text:A forklift had a purchase price of $10,000, delivery costs of

$2,000, a physical life of 6 years, and a useful life of 4 years.

Estimated residual value is zero. The annual depreciation

charge using the straight-line method is:

A. $2,500

B. $1,667

C. $3,000

D. $2,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardA machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years. Prepare depreciation schedules reporting the depreciation expense, accumulated depreciation, and book value of the machine for each year under the double-declining-balance and sum-of-the-years-digits methods. For the double-declining-balance method, round the depreciation rate to two decimal places.arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forward

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.arrow_forwardThe cost basis is $81,000. The useful life is five years with no salvage value. Please provide a depreciation schedule (d, for k = 1- 5) for 200% declining balance with switchover to straight line. Please specify the year to switchover. Determine the depreciation amounts using the 200% declining balance and straight-line methods and BV amounts for each year. (Round to the nearest dollar.) Depreciation SL Method, $ Amount Selected, 200% DB Year BVK Method, $ 1 3 4 Switchover occurs in year LOarrow_forwardThe cost of an asset is $1,050,000, and its residual value is $280,000. Estimated useful life of the asset is eight years. Calculate depreciation for the second year using the double - declining – balance method of depreciation. (Do not round any intermediate calculations, and round your final answer to the nearest dollar.) A. $196,875 B. $131,250 C. $192,500 D. $96,250arrow_forward

- . An asset was purchased six years ago at a cost of P7,000. It was estimated to have a useful life of ten years with a salvage value of 300 at the end of the time. It is now of no future use and can be sold for only P800. Determine the sunk cost if the depreciation has been computed by: a. The straight-line method. b. The sum-of-the-year’s digits methodarrow_forwardThe cost of an asset is $1,090,000, and its residual value is $240,000. Estimated useful life of the asset is eighteight years. Calculate depreciation for the first year using the doubleminus−decliningminus−balance method of depreciation. (Do not round any intermediate calculations, and round your final answer to the nearest dollar.) A. $106,250 B. $272,500 C. $136,250 D. $ 212,500arrow_forwardAn equipment costing P250, 000 has an estimated life of 15 years with a salvage value of P30, 000 at the end of the per i od. Compute the depreciation charge and its book value after 10 years using declining balance method.arrow_forward

- A utility vehicle purchased by Knox industries should last 110,000 miles .  the accusation cost was 21,200 and the salvage value is 1,913. Using the units of production depreciation method given the annual usage information calculate the accumulated depreciation at the end of year to round your depreciation per unit to three decimal places run your answer to the nearest cent.  year one 22,029.  Your two 22,724.  Year 3 23,420. year 4 23,188.  Answer key A.3,976.70 B.4,098.50 C.7,831.78 D.13,368.23 arrow_forwardA machine with a cost of $50,000 has an estimated residual value of $3,743 and an estimated life of 5 years or 18,397 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method? a.$12,000.00 b.$20,000.00 c.$10,000.00 d.$18,502.80arrow_forwardAn assembly line conveyor system with a 5-year life is to be depreciated by the DDB method. The conveyor units had a first cost of $30,000 with a$9000 salvage value. The annual operating cost allocated to the conveyor is $7000 per year. The book value at the end of year 2 is closest to:a. $6,480b. $10,800c. $12,400d. $18,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,