Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

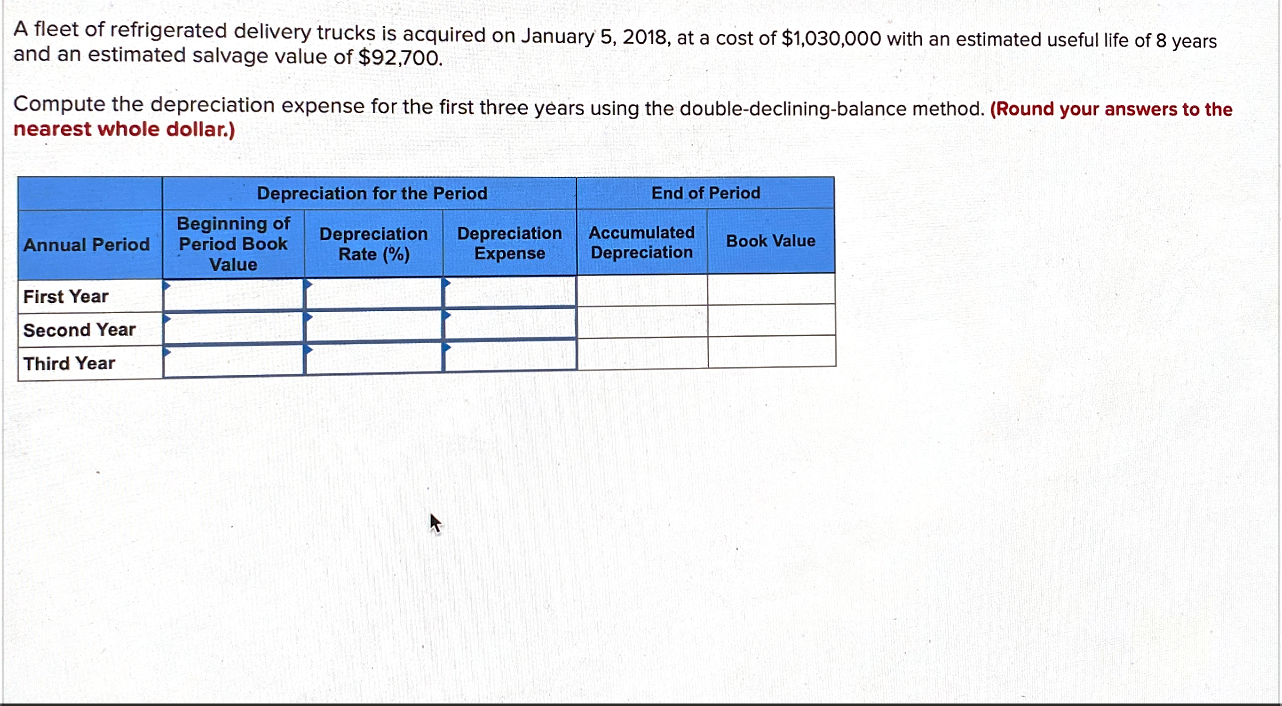

Transcribed Image Text:A fleet of refrigerated delivery trucks is acquired on January 5, 2018, at a cost of $1,030,000 with an estimated useful life of 8 years

and an estimated salvage value of $92,700.

Compute the depreciation expense for the first three years using the double-declining-balance method. (Round your answers to the

nearest whole dollar.)

Depreciation for the Period

End of Period

Beginning of

Period Book

Value

Depreciation

Rate (%)

Depreciation

Expense

Accumulated

Annual Period

Book Value

Depreciation

First Year

Second Year

Third Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Subject :- Accountarrow_forwardRevision of depreciation Equipment with a cost of $354,400 has an estimated residual value of $40,800, has an estimated useful life of 32 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. 9,800 ✔ b. Determine the book value after 18 full years of use. $ 178,000 ✓ c. Assuming that at the start of the year 19 the remaining life is estimated to be 18 years and the residual value is estimated to be $34,000, determine the depreciation expense for each of the remaining 18 years.arrow_forwardPlease show all your workarrow_forward

- An asset is purchased on January 1 at a cost of $25,000. It is expected to be used for four years and have a salvage value of $1,000. Calculate the depreciation expense for each year of the asset's useful life under each of the following methods: (Show Work) Straight-line method Double-declining-balance method Sum-of-the-years-digits' method a. Year Depreciation Book Value 1 2 3 4 b. Year Depreciation Book Value 1 2 3 4 c. Year Depreciation Book Value 1 2 3…arrow_forwardRequired information Use the following information for the Exercises below. (The following information applies to the questions displayed below.] On April 1, Cyclone's Co. purchases a trencher for $302,000. The machine is expected to last five years and have a salvage value of $51,000. Exercise 8-12 Double-declining-balance, partlal-year depreciation LO C2 Compute depreciation expense at December 31 for both the first year and second year assuming the company uses the double- declining-balance method. (Enter all amounts as positive values.) Depreciation for the Period End of Period Beginning of Annual Period Period Book Value Depreciation Rate Partial Year Depreciation Expense Accumulated Depreciation Book Value Year 1 Year 2arrow_forwardVisahnoarrow_forward

- A building is acquired on January 1 at a cost of $830,000 with an estimated useful life of eight years and salvage value of $75,000. Compute depreciation expense for the first three years using the double-declining-balance method. Note: Round your answers to the nearest dollar. Annual Period First Year Second Year Third Year P 4- Depvention for die Perod Beginning of Period Book Value Rate(%) prt sc delete backspace homearrow_forwardA building is acquired on January 1 at a cost of $1,030,000 with an estimated useful life of eight years and salvage value of $92,700. Compute depreciation expense for the first three years using the double-declining-balance method. (Round your answers to the nearest dollar.) Annual Period First Year Second Year Third Year Depreciation for the Period Depreciation Rate (%) Beginning of Period Book Value Depreciation Expense End of Period Accumulated Depreciation Book Valuearrow_forwardAn equipment costing P220,000 has an estimated life of 14 years with a book value of P30,000 at the end of the period. Compute the depreciation charge and its book value after 10 years using: a. straight-line method b. sinking fund method c. declining balance method d. sum of year's digit methodarrow_forward

- A building is acquired on January 1, at a cost of $900,000 with an estimated useful life of 10 years and salvage value of $81,000. Compute depreciation expense for the first three years using the double-declining-balance method. (Round your answers to the nearest dollar.)arrow_forwardA building is acquired on January 1 at a cost of $850,000 with an estimated useful life of eight years and salvage value of $76,500. Compute depreciation expense for the first three years using the double-declining-balance method. Note: Round your answers to the nearest dollar. Depreciation for the Period End of Period Annual Period Beginning of Period Book Value Depreciation Rate (%) Depreciation Expense Accumulated Depreciation Book Value First Year Second Year Third Yeararrow_forwardDetermine depreciation for that first year using both the Straight-Line Method and the Units of Activity Method as well as determine if there was a gain or loss on disposal from the problem below. On February 1, 2021, Harper Brewing Co. purchased a truck for $20,000. It's expected salvage value is $500. The estimated useful life (in years) is 5 years. And the estimated useful life (in miles) is 100,000. On December 31, 2021, Harper Brewing Co. sells the truck for $10,000 after driving it for 30,000 miles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education