Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

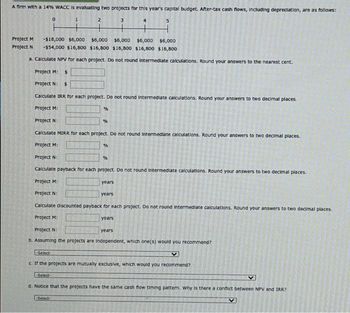

Transcribed Image Text:A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows:

Project M

Project N

-Select-

0

2

+

-$18,000 $6,000 $6,000 $6,000 $6,000

$6,000

-$54,000 $16,800 $16,800 $16,800 $16,800 $16,800

a. Calculate NPV for each project. Do not round Intermediate calculations. Round your answers to the nearest cent.

Project M: $

Project N: $

Calculate IRR for each project. Do not round Intermediate calculations. Round your answers to two decimal places.

Project M:

Project N:

Calculate MIRR for each project. Do not round Intermediate calculations. Round your answers to two decimal places.

Project M:

Project N

Calculate payback for each project. Do not round Intermediate calculations. Round your answers to two decimal places.

Project M:

Project N

years

Calculate discounted payback for each project. Do not round Intermediate calculations. Round your answers to two decimal places.

Project M:

-Select-

%

Select

%

%

%

years

3

years

Project N:

years

b. Assuming the projects are Independent, which one(s) would you recommend?

5

V

c. If the projects are mutually exclusive, which would you recommend?

d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Romanos Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Laura Berenstein, staff analyst at Romanos, is preparing an analysis of the three projects under consideration by Chester Romanos, the company's owner. Data Table A B C D 1 Project A Project B Project C 2 Projected cash outflow 3 Net initial investment $3,000,000 $2,100,000 $3,000,000 4 Projected cash inflows 5 Year 1 $1,200,000 $1,200,000 $1,700,000 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 8 Year 4 1,200,000 100,000 9 Required rate of return 10% 10% 10% 1. Because the company's cash is limited, Romanos thinks the payback method should be used to choose between the capital budgeting projects. a. What are the…arrow_forwardNonearrow_forwardA project proposal submitted to you for evaluation follow: Investment, including depreciable assets of P495,000 with economic life of six years) - Php 865,000 Annual sales revenue - PhP 750,00 Variable cost of sales - 43.5% Annual cash operating costs - 295,000 Income tax rate - 25% Required: a. Annual cash return, payback period and internal rate of return. b. If the corporate cost of capital is 8%, should the project be implemented ?arrow_forward

- Halls Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Laura Bentley, staff analyst at Halls, is preparing an analysis of the three projects under consideration by Caden Halls, the company's owner. Data Table A B C D 1 Project A Project B Project C 2 Projected cash outflow 3 Net initial investment $3,000,000 $2,100,000 $3,000,000 4 Projected cash inflows 5 Year 1 $1,200,000 $1,200,000 $1,700,000 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 8 Year 4 1,200,000 100,000 9 Required rate of return 6% 6% 6 1.. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Halls choose?. Ignore income taxes. (Round your answers to…arrow_forwardCompany is evaluating two projects, Project A and Project B. The initial investment on both the projects are $25,000. Both have equal lives. The Project A will generate cash flows of $20,000 and $35,000 in year 2 and year 3. The Project B will generate $15,000 in yea- 1, $22,000 year-2, and $25,000 in year-3. Compute the incremental (B-A) IRR. а. -21.38% b. 56.80% с. 21.38% d. -24.75%arrow_forwardA firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: 0 1 + 2 + -Select- % Project M -$6,000 $2,000 $2,000 $2,000 $2,000 $2,000 Project N -$18,000 $5,600 $5,600 $5,600 $5,600 $5,600 a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: years Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: years b. Assuming…arrow_forward

- A firm with a 13% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including yearly depreciation, are as follows: Project M -$6,000 $2,000 $2,000 $2,000 $2,000 $2,000 Project N -$18,000 $5,600 $5,600 $5,600 $5,600 $5,600 Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: years Project N: yearsarrow_forwardSuppose a company has the following three projects and limits it capital budget to $50,000. Projects Present Value of Cash Inflows Initial Investment A $40,000 $25,000 B 37,500 25,000 70,000 50,000 1. Calculate the projects' NPVs. 2. Calculate the projects' PIs. 3. Which project(s) should the company choose? Why?arrow_forwardThe management of Peridot Inc. is submitting a proposal to the Board of Directors for a new facility with the following cash flows. Year Cash flow 0 -214 1 52 2 61 3 74 4 82 The company's hurdle rate is 9%. internal rate of return for the proposed project is closest to: A. 10.15%. B. 9.06%. C. 9.00%.arrow_forward

- Assume the following information for a capital budgeting proposal with a five- year time horizon: Initial investment: Cost of equipment (zero salvage value) Annual revenues and costs: Sales revenues Variable expenses Depreciation expense Fixed out-of-pocket costs The payback period for this investment is closest to: Multiple Choice O O 2.71 years. 5.75 years. 3.54 years. 1.21 years. $ 460,000 $ 300,000 $ 130,000 $ 50,000 $ 40,000arrow_forwardJonathon Miller's Co, has provided the following information concerning a capital budgeting project: Investment required in equipment $160,000 Expected life of the project 4 years Salvage value of the equipment $0 Annual sales $360,000 Annual cash operating expenses $290,000 Working capital requirement $20,000 One-time renovation expense in year 3 $20,000 The company’s income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to: The following tables have been provided for your reference (using tables provided is optional): Present Value of $1; 1 / (1+r)n Periods 4% 5% 6% 7% 8% 9%…arrow_forwardFive engineering projects are being considered for the upcoming capital budget period. The interrelationships among the projects and the estimated net cash flows of the projects are summarized in the following table: Projects B1 and B2 are mutually exclusive. Projects C1 and C2 are mutually exclusive and dependent on the acceptance of B2. Finally, project D is dependent on the acceptance of C1. Using the PW method, and assuming that MARR = 10% per year, determine which combination (portfolio) of projects is best if the availability of capital is limited to $48,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education