EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Market value of equity to its book value? General accounting

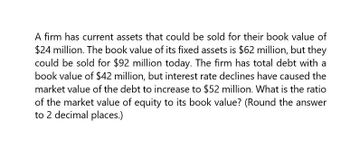

Transcribed Image Text:A firm has current assets that could be sold for their book value of

$24 million. The book value of its fixed assets is $62 million, but they

could be sold for $92 million today. The firm has total debt with a

book value of $42 million, but interest rate declines have caused the

market value of the debt to increase to $52 million. What is the ratio

of the market value of equity to its book value? (Round the answer

to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has current assets that could be sold for their book value of $24 million. The book value of its fixed assets is $62 million, but they could be sold for $92 million today. The firm has total debt with a book value of $42 million, but interest rate declines have caused the market value of the debt to increase to $52 million. What is the ratio of the market value of equity to its book value? (Round the answer to 2 decimal places.)arrow_forwardGive correct solution for this questionarrow_forwardhi expert please help mearrow_forward

- Assume Bismuth Electronics has a book value of $6 billion of equity and a face value of $19.7 billion of debt. The market values of equity and debt are $2.5 billion and $18.5 billion. A Wall Street financial analyst determines values of equity and debt as $3 billion and $20 billion. Which of the following values should be used for calculating the firm's WACC? A) $6 billion of equity and $19.7 billion of debt B) $2.5 billion of equity and $20 billion of debt C) $3 billion of equity and $19.9 billion of debt D) $2.5 billion of equity and $18.5 billion of debtarrow_forwardUse the following information to value a firm’s assets. Assume the following: the market value of the firm's assets is expected to remain constant over time so the firm doesn't grow and can be valued as a level perpetuity, the firm has a constant debt-to-assets ratio, the bonds are priced at par, and the stock's expected capital returns are zero. Relevant data: The number of shares on issue is 1 million and the number of bonds is 800,000 The constant annual dividend per share is $3 The bonds have an annual fixed coupon payment of $2.50 10-year government bonds have a yield of 2% and the market risk premium is 5% The beta of levered equity is 1.2 The beta of the bonds is 0.9 Which of the following is the market value of the levered firm’s assets? a. $68.3 million b. $21.2 million c. $70.1 million d. $42.9 million e. $54.7 millionarrow_forwardAn unlevered firm has expected earnings of $2,401 and a market value of equity of $19,600. The firm is planning to issue $4,000 of debt at 6 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forward

- A firm plans to grow at an annual rate of at least 16%. Its return on equity is 24%. Suppose the firm has a debt-equity ratio of 1/3. What is the maximum dividend payout ratio it can maintain without resorting to any external financing? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. 33.33 X % Maximum dividend payout ratioarrow_forwardConsider a simple firm that has the following market-value balance sheet: Assets Liabilities end equity $1 040 Debt Equity $400 640 Next year, there are two possible values for its assets, each equally likely: $1 180 and $960. Its debt will be due with 4.9% interest. Because all of the cash flows from the assets must go to either the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 38% in the firm's debt and 62% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets. If the assets will be worth $1 180 in one year, the expected return on assets will be %. (Round to one decimal place.)arrow_forwardI need answer of this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT