Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

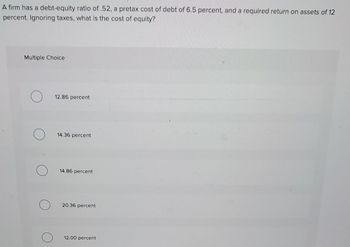

Transcribed Image Text:A firm has a debt-equity ratio of .52, a pretax cost of debt of 6.5 percent, and a required return on assets of 12

percent. Ignoring taxes, what is the cost of equity?

Multiple Choice

12.86 percent

14.36 percent

14.86 percent

20.36 percent

12.00 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm is financed with debt that has a market beta of 0.3 and equity that has a market beta of 1.2. The risk-free rate is 3%, and the equity premium is 5%. The overall cost of capital for the firm is 8%. What is the firmʹs debt-equity ratio? Group of answer choices 28.6% 25.0% 25.2% 74.8%arrow_forwardA firm has a cost of debt of 6.2 percent and a cost of equity of 13.3 percent. The debt–equity ratio is .96. There are no taxes. What is the firm's weighted average cost of capital?arrow_forwardAccording to the simplified Brennan Lally CAPM, what is the cost of equity for A Ltd? Using the cost of debt, cost of equity, market value of debt and market value of equity given in the table given, what is the weighted average cost of capital (WACC) for B Ltd? Thank you!arrow_forward

- Give typing answer with explanation and conclusion Fama's Llamas has a weighted average cost of capital of 11.5 per cent. The company's cost of equity is 16 per cent, and its cost of debt is 8.5 per cent. The tax rate is 35 per cent. What is Fama's debt–equity ratio?arrow_forwardAJ.2arrow_forwardPrecision Cuts has a target debt-equity ratio of .48. Its cost of equity is 16.4 percent, and its pretax cost of debt is 8.2 percent. If the tax rate is 21 percent, what is the company's WACC? Group of answer choices A) 13.18% B) 11.72% C) 12.91%arrow_forward

- 3. Company WACC is 20%. Debt interest rate is 4% and D/ E ratio is 1,6. What is the cost of equity? HOW YOU CALCULATE THIS WITH EXCEL AND USING EXCEL FORMULAS?arrow_forwardYour firm has a Return on Assets of 8.00 %, the firm can issue debt at 3.50% regardless of the leverage, and the firm's marginal tax rate is 25%. If the firm's debt-to-asset ratio is 24%, what is the Cost of Equity Capital within the 1963 Miller & Modigliani framework? Group of answer choices 9.35% 9.78% 6.77% 9.07% 8.81%arrow_forwardA firm had a debt ratio of 0.85. The pretax cost of debt is 8% and the reqiured return on asset is 15.5%. What is the cost of equity if we factorin the firms tax rate of 24%? A) 19.53 B) 18.92 C) 21.57 D) 20.35 E) 20.96arrow_forward

- Suppose your firm has a market value of equity is $500 million and a market value of debt is $475 million. What are the capital structure weights (i.e., weight of equity and weight of debt)? Group of answer choices A) weight of equity is 51.28%, , weight of debt is 48.72% B) weight of equity is 48.72%, , weight of debt is 51.28% C) weight of equity is 47.62%, , weight of debt is 52.38%arrow_forwardA firm has a debt-equity ratio of 0.5 and a cost of debt of 5 percent. The industry average cost of unlevered equity is 15 percent. What is the weighted average cost of capital for this firm? Ignore tax. O 0.12 O 0.13 0.14 O 0.15arrow_forwardWhat is the debt ratio for a firm with an equity multiplier of 3.5? ____ 44.09 percent ____ 58.51 percent ____ 66.25 percent ____ 71.43 percentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education