Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

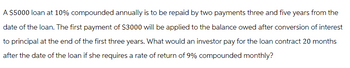

Transcribed Image Text:A $5000 loan at 10% compounded annually is to be repaid by two payments three and five years from the

date of the loan. The first payment of $3000 will be applied to the balance owed after conversion of interest

to principal at the end of the first three years. What would an investor pay for the loan contract 20 months

after the date of the loan if she requires a rate of return of 9% compounded monthly?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to borrow $350,000 at a 7.5% annual interest rate. The terms require you to amortize the loan with equal end-of- month payments for 15 years (180 months). How much interest would you be paying in the 75th month?arrow_forwardYou are purchasing a $79,500 house with monthly payments on a twenty-year note with interest at 6.8% compounded monthly. Show just the first two months of the loan amortization schedule.arrow_forwardSuppose a graduate student receives a non-subsidized student loan of $11,000 for each of the 4 years the student pursues a PhD. If the annual interest rate is 3% and the student has a 10-year repayment program, what are the student's monthly payments on the loans after graduation? (Round your answer to the nearest cent.)arrow_forward

- A$66.000interest-only mortgage loan is made for 30 years at a nominal interest rate of 8 percent. Interest is to be accrued daily, but payments are to be made monthly. Assume 30 days each month. Required: a. What will the monthly payments be on such a loan? b. What will the loan balance be at the end of 30 years? c. What is the effective annual, rate on this loan?arrow_forwardA floating rate mortgage loan is made for $170,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,360. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,360? Complete this question by entering your answers in the tabs below. Required A Required B What will be the loan balance at the end of year 1? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Loan balancearrow_forwardWhat is the monthly payment to repay a 10 year loan of $200,000 at a nominal rate of 15% per year if the interest is compounded quarterly? Assume interperiod compounding.arrow_forward

- Determine the monthly payment if you take out a loan for $ 200000 with an annual interest rate of 7% and the term of the loan is 20 years. Monthly Payment =arrow_forwardwhat is the present value of a loan that calls for the payment of $500 per year for six years if the discount rate is 10 percent and yne forst payment will be made one year from now ? how would your answer change if $500 per year occured for ten years ?arrow_forwardA $190,000 mortgage is to be amortized by making monthly payments for 20 years. Interest is 6.5% compounded semi-annually for a 3-year term. If the mortgage is renewed for a 5-year term at 7.25% compounded semi-annually, what is the size of the monthly payment for the renewal term?arrow_forward

- Calculate the interest payments each year for a three-year loan of $30000 with 6% annual interest rate under the following conditions: the loan requires equal annual payments; the loan requires equal annual principal reduction..arrow_forwardYou borrow 112000 for 10 years from a bank in order to renovate your flat. The effective interest rate charged by the bank is 7.6% per annum. The loan is to be repaid by level annual repayments, paid in arrears. Calculate the annual repayment. Give your answer to two decimal places.arrow_forwardPrescott Bank offers you a $22,000, 6-year term loan at 10 percent annual interest. What will your annual loan payment be?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education