FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

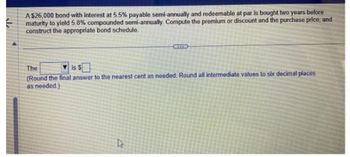

Transcribed Image Text:A $26,000 bond with interest at 5.5% payable semi-annually and redeemable at par is bought two years before

maturity to yield 5.8% compounded semi-annually. Compute the premium or discount and the purchase price, and

construct the appropriate bond schedule.

The

is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places

as needed.)

h

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- Sagararrow_forwardCalculate the annual interest that you will receive on the described bond. A $500 Treasury bond with a current yield of 4.2% that is quoted at 107 points The annual interest is $ (Round to the nearest cent as needed.)arrow_forwardA newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 3.5% and face value $1,000. Find the imputed interest income in: (a) the first year; (b) the second year; and (c) the last year of the bond’s life. (Round your answers to 2 decimal places.)arrow_forward

- Determine the purchase price at the indicated time before maturity of the following bond redeemed at par shown in the table below. Par Value Bond Rate Payable Semi-Annually Time Before Redemption Yield Rate Conversion Period $30,000 9.5% 10.5 vears 9% monthly The purchase price of the bond is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardCalculate the Macaulay duration of a 9%, $1,000 par bond that matures in three years if the bond's YTM is 12% and interest is paid semiannually. a. Calculate this bond's modified duration. Do not round intermediate calculations. Round your answer to two decimal places. years b. Assuming the bond's YTM goes from 12% to 11.5%, calculate an estimate of the price change. Do not round intermediate calculations. Round your answer to three decimal places. Use a minus sign to enter negative value, if any. %arrow_forwardUse the following tables to calculate the present value of a $375,000 @ 5%, 5-year bond that pays $18,750 interest annually, if the market rate of interest is 10%. Round to the nearest dollar. Present Value of $1 ¦ Present Value of Annuity of $1 Periods 5 % 6 % 7 % 10 % ¦ Periods 5 % 6 % 7 % 10 % 1 .95238 .94340 .93458 .90909 ¦ 1 .95238 .94340 .93458 .90909 2 .90703 .89000 .87344 .82645 ¦ 2 1.85941 1.83339 1.80802 1.73554 3 .86384 .83962 .81630 .75131 ¦ 3 2.72325 2.67301 2.62432 2.48685 4 .82270 .79209 .76290 .68301 ¦ 4 3.54595 3.46511 3.38721 3.16987 5 .78353 .74726 .71299 .62092 ¦ 5 4.32948 4.21236 4.10020 3.79079 6 .74622 .70496 .66634 .56447 ¦ 6 5.07569 4.91732 4.76654 4.35526 7 .71068 .66506 .62275 .51316 ¦ 7 5.78637 5.58238 5.38929 4.86842 8 .67684 .62741 .58201 .46651 ¦ 8 6.46321…arrow_forward

- Calculate the Macaulay duration of an 11%, $1,000 par bond that matures in three years if the bond's YTM is 12% and interest is paid semiannually. Calculate this bond's modified duration. Do not round intermediate calculations. Round your answer to two decimal places. years Assuming the bond's YTM goes from 12% to 11.0%, calculate an estimate of the price change. Do not round intermediate calculations. Round your answer to three decimal places. Use a minus sign to enter negative value, if any. %arrow_forwarda 29000 bond with interest at 5.1% payable semi annually and redeemable ar par is bought two years before maturity to yield 7.8% compunded semi annually. complete the premium or discount and the purchase price and construct the appropriate bond schedulearrow_forwardSeaside issues a bond with a stated interest rate of 12%, the face value of $40,000, and due in 8 years. Interest payments are made semi-annually. The market rate for this type of bond is 14%. What is the issue price of the bond?arrow_forward

- Determine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 11 years, interest paid annually, stated rate 10%, effective (market) rate 12%. Maturity 11 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. Maturity 11 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Maturity 9 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Maturity 9 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%.arrow_forwardLast year, Kevin Thomas purchased a $1000 Campbell Manufacturing corporate bond with an annual interest rate of 7.25%. The bond's current market price is $770. Calculate the following. If necessary, round all answers to two decimal places. If necessary, refer to the list of financial formulas. 1. Annual interest: 2. Current yield: $0 0% X Sarrow_forwardGiven the following spot and forward rates: Current 1-year spot rate is 3.12%. One-year forward rate one year from today is 4.34%. One-year forward rate two years from today is 5.11%. One-year forward rate three years from today is 6.25%. Calculate the value of a 4-year, 7.2% annual-pay, $1,000 par value bond. A. $1,076.72 B. $1,182.22 C. $1,231.59 D. $1,327.61arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education