ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

solve d and(e)

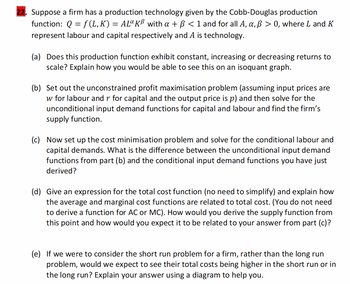

Transcribed Image Text:Suppose a firm has a production technology given by the Cobb-Douglas production

function: Q=f(L,K) = AL¤ KB with a + ß < 1 and for all A, a, ß > 0, where L and K

represent labour and capital respectively and A is technology.

(a) Does this production function exhibit constant, increasing or decreasing returns to

scale? Explain how you would be able to see this on an isoquant graph.

(b) Set out the unconstrained profit maximisation problem (assuming input prices are

w for labour and r for capital and the output price is p) and then solve for the

unconditional input demand functions for capital and labour and find the firm's

supply function.

(c) Now set up the cost minimisation problem and solve for the conditional labour and

capital demands. What is the difference between the unconditional input demand

functions from part (b) and the conditional input demand functions you have just

derived?

(d) Give an expression for the total cost function (no need to simplify) and explain how

the average and marginal cost functions are related to total cost. (You do not need

to derive a function for AC or MC). How would you derive the supply function from

this point and how would you expect it to be related to your answer from part (c)?

(e) If we were to consider the short run problem for a firm, rather than the long run

problem, would we expect to see their total costs being higher in the short run or in

the long run? Explain your answer using a diagram to help you.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the details of the quantity to be produced for a period are as follows, how many units are produced? The opening inventory is 160 units; units sold are estimated to be 200 units; the desired closing stock is 100 units. a. 200 units b. 260 units c. 460 units d. 140 unitsarrow_forwardBVM manufactured and sold 25,000 small statues this past year. At that volume, the firm was exactly in a breakeven situation in terms of profitability. BVM’s unit costs are expected to increase by 30% next year. What additional information is needed to determine how much the production volume/sales would have to increase next year to just break even in terms of profitability? (a) Costs per unit (b) Sales price per unit and costs per unit (c) Total fixed costs, sales price per unit, and costs per unit (d) No data is needed, the volume increase is 25, 000 + 25, 000(0.30) = 32, 500 units.arrow_forwardNonearrow_forward

- Solve all the parts and add explanation and check answer twicearrow_forwardIn this problem annual income for ages 20 to 80 is given graphically. People sometimes spend less than their income (to save for retirement) or more than their income (taking out a loan). The process of spreading out spending over a lifetime is called consumption smoothing. annual income ($10nns nar vaar) years) (a) Find the average annual income for these years. The average annual income is dollars/year. eTextbook and Media (b) Assuming that people spend at a constant rate equal to their average income, when are they spending less than they earn, and when are they spending more? Enter your answers in increasing order. They spend less than their income every year from age to They spend more than their income every year from age to and from age toarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education