ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

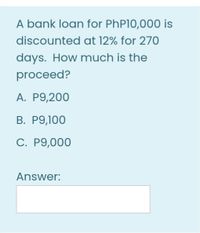

Transcribed Image Text:A bank loan for PhP10,000 is

discounted at 12% for 270

days. How much is the

proceed?

A. P9,200

В. Р9,100

C. P9,000

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Mary Purchales a $500 bond that has 6 remaining Sem!- annum) 6%. Coupon payments for $450. what would be his return' per' half year periodarrow_forwardWhat is the annual worth for option the cost is $200 and the uniform annual benifit is $55.48 for 5 years. intrest rate is 8%. Answer to be in Two Decimal places.arrow_forward1. The maintenance cost for a certain machine is $1,000 per year for the first 5 years and $2,000 per year for the next 5 years. At an interest rate (compounded) of 10% per year, the present worth of the maintenance is closest to: A. Less than $7,000 B. $7,450 C. $8,500 D. More than $9,000arrow_forward

- A Startup is considering buying a $300,000 prece of equipment. If it puranases the equipment, to will take a loan for the entire amout; the interest on the loan is 3%. and the luan will be repond in 5 equal end of year payments. The Startup estimaks that the equipment would generall an additional $160,000 of revenue each year. At the end of 5 year, the equipment would have a salvague. value of $20,000. The tax rate is 25% Assuming a planning horizon of 5 years. that the equipment as depreciated using MACKS (3-year property class) and that the medical practice uses MARK of 7%. an after tax (a) Compute the Present Worth and determine whether the startup Should invest in the equipment (b) Re - compute the present worth if there exists a cl. inflation / year. would descision your change?arrow_forwardEngineering economy - ENGR 3322 The International Parcel Service has installed a new radio frequency identification system to help reduce the number of packages that are incorrectly delivered. The capital investment in the system is $65,000, and the projected annual savings are tabled below. The system’s market value at the EOY five is negligible, and the MARR is 18% per year. Calculate the present worth of the project. a. $ 35,730 b. $ 36,730 c. $ 37,730 d. None of the choicesarrow_forwardDemand for a new product will decline as competitors enter the market. If interest is 10%, what is an equivalent uniform value?arrow_forward

- A cutting-edge product of Continental Fan had the following net cash flow series during its first 5-year period on the market. Find all rate of return values between 0% and 100%. (Round the final answer to three decimal places.) Year 0 1 2 3 45 5 The rate of return is %. Net Cash Flow, $ -54,000 37,000 29,000 10,000 -5,000 13,000arrow_forwardplz help correctarrow_forwardPlease show the solution of finding the i*value which is 8.7%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education