FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

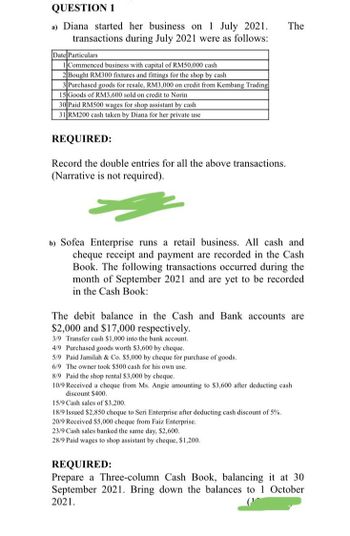

Transcribed Image Text:QUESTION 1

a) Diana started her business on 1 July 2021.

transactions during July 2021 were as follows:

Date Particulars

Commenced business with capital of RM50,000 cash

Bought RM300 fixtures and fittings for the shop by cash

3 Purchased goods for resale, RM3,000 on credit from Kembang Trading

15 Goods of RM3,600 sold on credit to Norin

30 Paid RM500 wages for shop assistant by cash

31 RM200 cash taken by Diana for her private use

REQUIRED:

Record the double entries for all the above transactions.

(Narrative is not required).

The

b) Sofea Enterprise runs a retail business. All cash and

cheque receipt and payment are recorded in the Cash

Book. The following transactions occurred during the

month of September 2021 and are yet to be recorded

in the Cash Book:

The debit balance in the Cash and Bank accounts are

$2,000 and $17,000 respectively.

3/9 Transfer cash $1,000 into the bank account.

4/9 Purchased goods worth $3,600 by cheque.

5/9 Paid Jamilah & Co. $5,000 by cheque for purchase of goods.

6/9 The owner took $500 cash for his own use.

8/9 Paid the shop rental $3,000 by cheque.

10/9 Received a cheque from Ms. Angie amounting to $3,600 after deducting cash

discount $400.

15/9 Cash sales of $3,200.

18/9 Issued $2,850 cheque to Seri Enterprise after deducting cash discount of 5%.

20/9 Received $5,000 cheque from Faiz Enterprise.

23/9 Cash sales banked the same day, $2,600.

28/9 Paid wages to shop assistant by cheque, $1,200.

REQUIRED:

Prepare a Three-column Cash Book, balancing it at 30

September 2021. Bring down the balances to 1 October

2021.

(¹

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The transactions of Mr. Azizul Hani, a merchant for the month of March 2023 are as follows. 2023 RM March 1 Starting a business with cash as capital 5 000 3 Buy merchandise on credit from Razi 850 5 Sell merchandise on credit to Chia 800 10 Buy an office desk for cash 750 12 Cash purchase 1 000 14 Cash sale 900 17 Sell merchandise on credit to Zam 2 250 18 Pay Razi in cash 250 24 Pay general expenses with cash 200 31 Chia settled the debt in full with cash 800 You are required to record the above transactions into the ledger account and balance.arrow_forwardNet Income? Ali Mamat Enterprise Trial Balance as at 31 December 2019 Particulars Sales Purchases Salaries Motor expenses Rent Insurance General expenses Premises Motor vehicles Account receivables Account payable Cash at bank Cash in hand Drawings Capital TOTAL Debit (RM) Credit (RM) 190,576 119,832 56,527 2,416 1,894 372 85 95,420 16,594 26,740 16,519 342 8,425 345.166 16,524 138,066 345.166arrow_forwardH1. Accountarrow_forward

- 3arrow_forward2. Transfer the journal entry into the general ledger and related subsidiary ledger 3. Prepare a Trial Balance on 31 Jan 2021arrow_forwardK Bryson Inc. collects cash from customers two ways: 1. Accrued Revenue. Some customers pay Bryson after Bryson has performed service for the customer. During 2020, Bryson made sales of $53,000 on account and later received cash of $45,000 on account from these customers. 2. Unearned Revenue. A few customers pay Bryson in advance, and Bryson later performs service for the customer. During 2020, Bryson collected $6,500 cash in advance and later earned $5,000 of this amount. Journalize the following for Bryson: a. Earning service revenue of $53,000 on account and then collecting $45,000 on account b. Receiving $6,500 in advance and then earning $5,000 as service revenue a. Journalize Bryson earning service revenue of $53,000 on account and then collecting $45,000 on account. Start by recording earning service revenue on account. (Record debits first, then credits. Explanations are not required.) Date 2020 Accounts Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education