FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

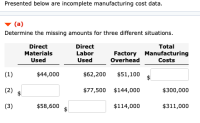

Transcribed Image Text:(a)

Determine the missing amounts for three different situations.

Direct

Materials

Used

Direct

Labor

Used

Total

Factory Manufacturing

Overhead

Costs

(1)

$44,000

$62,200

$51,100

(2)

$77,500 $144,000

$300,000

(3)

$58,600

$114,000

$311,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below are certain operating data for the four departments of Tally Manufacturing Company. Service Production 1 2 1 2 Total manufacturing overhead costs either identifiable with or allocated to each department $72,000 $86,400 $108,000 $117,600 Square feet of factory floor space 48,000 96,000 Number of factory workers 110 70 Planned direct labor hours for the year 24,000 36,000 Allocate, to the two production departments, the costs of service departments 1 and 2, using factory floor space and number of workers, respectively, as bases. Do not round bases when calculating reallocations of service departments. Production 1 2 Identifiable and allocated overhead Answer Answer Reallocation of service departments: Dept. 1 Factory floor space Answer Answer Dept. 2 Number of factory workers Answer Answer Total manufacturing overhead Answer Answer What is the apparent…arrow_forwardCompute conversion costs given the following data: direct materials, $353,800; direct labor, $206,900; factory overhead, $205,600 and selling expenses, $47,600. Oa. $559,400 Ob. $158,000 Oc. $412,500 Od. $766,300arrow_forwardPlease provide correct solution for correct answerarrow_forward

- I want to correct answer for this questionarrow_forwardPlease do not give solution in image format thankuarrow_forwardDetermine the missing amount for each separate situation involving manufacturing costs. Direct materials used Direct labor used Factory overhead Total manufacturing costs $ (1) 10,000 $ 6,000 7,000 $ (2) 16,000 25,000 52,000 $ (3) 20,000 24,000 74,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education