ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

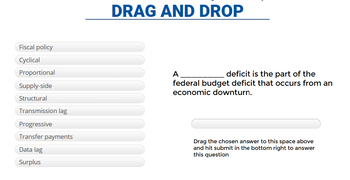

Transcribed Image Text:Fiscal policy

Cyclical

Proportional

Supply-side

Structural

Transmission lag

Progressive

Transfer payments

Data lag

Surplus

DRAG AND DROP

A

deficit is the part of the

federal budget deficit that occurs from an

economic downturn.

Drag the chosen answer to this space above

and hit submit in the bottom right to answer

this question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Explain how a budget deficit arises and what actions governments must take in this circumstance. How does the budget deficit relate to the national debt?arrow_forwardDeficit may be defined as? Public Debt Intergovernmental Debt Debt created solely because the government failed to balance its budget in a given fiscal year All of the abovearrow_forwardA government's debt is reduced when it Group of answer choices runs a surplus. runs a deficit. balances is budget. sells more bonds.arrow_forward

- Describe how the federal deficit is a burden on the shoulders of future generations.arrow_forwardWhich of the following might increase the government budget deficit? contractionary fiscal policy expansionary fiscal policy expansionary monetary policy contractionary monetary policyarrow_forwardWhat budget changes would have to occur in order to lower an annual deficit? Annual expenditures would have to rise. Annual expenditures would have to decline and annual tax collections would have to rise. Annual tax collections would have to fall. Annual expenditures would have to rise and annual tax collections would have to fall.arrow_forward

- The government starts with a debt of $4 billion. In year one, the government runs a deficit of $600 million. In year two, the government runs a deficit of $1 billion. In year three, the government runs a surplus of $300 million. What is the total debt of the government at the end of year three? Show work.arrow_forwardWhich of the following is a reason for using expansionary fiscal policy during a recession? a) reduce unemployment b) All of the choices are correct c) help the economy return to full employment d) help increase GDP, job opportunities, and production in the economy e) increase employmentarrow_forwardRefer to the diagram, where T is tax revenues and G is government expenditures. All figures are in billions of dollars. If the full-employment GDP and actual GDP are each $400 billion, this economy will realize a Multiple Choice cyclically adjusted deficit of $20 billion. cyclical deficit of $20 billion. cyclical surplus of $20 billion. cyclically adjusted deficit of zero.arrow_forward

- Find the primary deficit if the fiscal deficit is 52 and the interest payments are 12arrow_forwardThe government debt is None of these answers is correct. the total accumulation of deficits in the current period. the outstanding stock of bonds that have been issued in the past. equal to total tax receipts. the annual difference between government spending and tax revenues.arrow_forwardThe federal government ran a budget surplus in the late 1990 and in the year 2000, but has since returned to running a budget deficit. Explain why reducing the budget deficit can cause short-term pain in the form of lower employment, higher unemployment, and a recession. (Use diagram and analysis)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education