ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

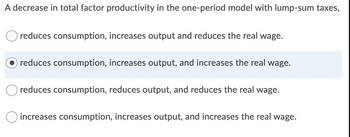

Transcribed Image Text:A decrease in total factor productivity in the one-period model with lump-sum taxes,

reduces consumption, increases output and reduces the real wage.

reduces consumption, increases output, and increases the real wage.

reduces consumption, reduces output, and reduces the real wage.

increases consumption, increases output, and increases the real wage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Imagearrow_forward14) The A) increase; rigid C) decline; flexible in employment during a recession is smaller if wages are B) decline; rigid D) increase; flexiblearrow_forwardThe trough of the business cycle: O is a temporary maximum level of real GDP. comes before the recession phase. comes right after the expansion phase. is a temporary minimum level of real GDP.arrow_forward

- Consider a two-period model in which the goverment introduces a tax on interest earnings. This means that borrowers pay a net interest rate of r, however lenders (savers) receive a net interest rate of (1 – t)r on their savings, where t is the tax rate withheld by the government and is a multiplication sign. Let r = 8 percent and t = 28 percent. Consider a consumer who is a saver. Answer parts a), b), c) and d) below. Round your numerical answer in part a) to 3 decimal places. a). The relative price of consumption today to consumption tomorrow for this saver is b). Suppose the tax rate increases. How does the saver's relative price of consumption today change? A. Consumption today has the same price relative to consumption tomorrow. B. Consumption today becomes relatively more expensive C. Consumption today becomes relatively cheaper c). As a result, the substitution effect shows that A. Consumption today increases, while consumption tomorrow decreases B. Consumption today remains…arrow_forwardSuppose country A has the following system of taxes/transfers: ANAL (a) Income 200: Taxed at 40%. In this country, we assume that everyone receives 5 per hour as wages. A worker chooses how many hours she wants to work. Her preferences over aggregate consumption, c, and 41 abor, I, are represented by the following utility function U(c, 1) =c+0ln(31-1) where 0 is a parameter reflecting drudgery of work (i.e. how painful the work is). Assuming 0 = 60 for the worker and given the system of axes/transfers, what is her optimal choice of labor? A 1=21 B 1 20 C 1* = 19 D 1*=22 48 55arrow_forwardConsider the following one-period model. Consumer Utility function over consumption (C) and leisure (L) U(C,L)= C^(1/2)L^(1/2) = Total hours: H = 40 Labour hours: = H – L Non-labour income: π Lump-sum tax: T Hourly wage: w Firm Production function: Y = zF() = z Total factor productivitiy: z = 2 Government Government spending (exogenous): G = 20 Suppose that the total factor productivity, z, increases to 5. What is the substitution effect of this wage change on labour supply()? A. +8.51 B. -5.51 C. -8.51 D. +5.51 E. None of the abovearrow_forward

- Output in Winston-Salem is produced using labor, L, and capital, K. Initially there is a fixed amount of capital, K0, and a fixed amount of money. All residents of Hickory only uses this form of money for all their transactions. A large thunderstorm floods Winston-Salem. The flood destroys 20 percent of all capital but does not injure or kill anyone. What happens to real wages and output, respectively? Increase, decrease none of the answers are correct Decrease, unchanged Increase, uncertain Increase, increasearrow_forwardExhibit 12-4 Price level Potential output SRAS increase taxes AD Real GDP If the government wants the economy illustrated in Exhibit 12-4 to be at full employment, it should decrease transfer payments decrease government purchases wait for the SRAS curve to shift to the left do none of the abovearrow_forwardRespond to the question with a concise and accurate answer, along with a clear explanation and step-by-step solution, or risk receiving a downvote.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education