FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

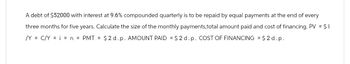

Transcribed Image Text:A debt of $52000 with interest at 9.6% compounded quarterly is to be repaid by equal payments at the end of every

three months for five years. Calculate the size of the monthly payments,total amount paid and cost of financing. PV = $1

/YC/Y = n = PMT = $2 d. p. AMOUNT PAID $2 d. p. COST OF FINANCING = $2d.p.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A debt of $6434is to be settled by two equal payments due in 1 month and 7 months respectively. Determine the amount of the equal payments if money is worht 6% compounded monthly and the focal date is today.arrow_forwardAn amount of $8,430 is deposited into an account earning 7% interest compounded quarterly. How much will be in the account in 5 years and 9 months? Round the answer to the nearest cent. P/Y = C/Y = N = I/Y = PV = PMT = FV =arrow_forwardA debt of $6436.51 is repaid by payments of $1707.02 in 3 months, $1233.91 in 13 months, and a final payment in 23 months. If interest was 8% compounded semi-annually, what was the amount of the final payment?arrow_forward

- A debt of $52000 with interest at 9.6% compounded quarterly is to be repaid by equal payments at the end of every three months for five years. Calculate the size of the monthly payments,total amount paid and cost of financing. PV =$ I/Y= C/Y= i= n = PMT=$ AMOUNT PAID =$ COST OF FINANCING=$ 2 d.p. 2 d.p. 2 d.p.arrow_forwarda demand loan of 7000$is repaid by payments of 3500$ after two years, 3500$ after four years and a funal payment after seven years. interfest rate is 9% compunded quarterly for the first two years, 10% compoiunded annuannly for the next two years, and 10% compounded mointhly thereafter. what is the size of the final payment?arrow_forwardonsider the following loan. Complete parts (a)-(c) below. n individual borrowed $65,000 at an APR of 5%, which will be paid off with monthly payments of $442 for 19 years. ... a. Identify the amount borrowed, the annual interest rate, the number of payments per year, the loan term, and the payment amount. The amount borrowed is $ 65000, the annual interest rate is 5%, the number of payments per year is 12, the loan term is 19 years, and the payment amount is $ 442. b. How many total payments does the loan require? What is the total amount paid over the full term of the loan? There are 228 payments toward the loan and the total amount paid is $ 100776 c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest? The percentage paid toward the principal is% and the percentage paid for interest is%. (Round to the nearest tenth as needed.)arrow_forward

- A debt of $1908 with interest at 6.3% compounded annually is to be repaid by equal payments at the end of each year for 4 years. 1. What is the balance remaining (BAL) after the first payment? 2. What is the principal repaid (PRN) in the first period? 3. What is the interest paid (INT) in the first period?arrow_forwardFind the payment necessary to amortize a 12% loan of $2300 compounded quarterly, with 12 quarterly payments. The payment size is $ (Round to the nearest cent.)arrow_forwardFind the payment necessary to amoritize a 4% loan of $1600 compounded quarterly, with 9 quarterly payments The payment size is % (Round to the nearest cent.)arrow_forward

- Find the payment necessary to amortize a 12% loan of $2000 compounded quarterly, with 18 quarterly payments. The payment size is $ (Round to the nearest cent.)arrow_forwardA loan of 814, 000 is to be repaid in 20 years by month - end repayments starting in one month. The interest rate is 8.3% p.a. compounded monthly. Calculate the principal paid in Year 6. (between the end of month 60 and the end of month 72). Correct your answer to the nearest cent without any units. (Do not use "$" or ","in your answer. e.g. 12345.67) (Hint: you can use Excel to find the answer.)arrow_forwardA debt of $3051 with interest at 7.27% compounded monthly is to be repaid by equal payments at the end of each month for 5 years. What is the balance remaining (BAL) after the first payment? Payment Number 0 1 Answer: PMT INT PRN BAL 3051 ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education