Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

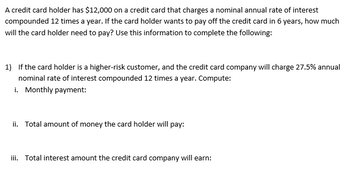

Transcribed Image Text:A credit card holder has $12,000 on a credit card that charges a nominal annual rate of interest

compounded 12 times a year. If the card holder wants to pay off the credit card in 6 years, how much

will the card holder need to pay? Use this information to complete the following:

1) If the card holder is a higher-risk customer, and the credit card company will charge 27.5% annual

nominal rate of interest compounded 12 times a year. Compute:

i. Monthly payment:

ii. Total amount of money the card holder will pay:

iii. Total interest amount the credit card company will earn:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Suppose that $4000 is placed in a savings account at an annual rate of 10.8%, compounded monthly. Assuming that no withdrawals are made, how long will it take for the account to grow to $6260? do not round any intermediate computations, and round your answer to the nearest hundreth.arrow_forward4)Jonathan invests $8,980 in a bank. The bank pays 5.8% interest compounded quarterly a)How long must he leave the money in the bank for it to double? Round to nearest tenth of a year. Show your work. b)How long will it take to triple? Round to nearest tenth of a year. Show your work. c)If Jonathan is given the choice to invest his money at 5.8% interest compounded quarterly for 5 years or invest his money compounding annually at a rate of 5.85% for 5 years, which option would be best for Jonathan? Explain and show your work.arrow_forwardHow much should a $10,000 facevalue, zero-coupon bond, maturing in 10 years, be sold for now if its rate of return is to be 8% compounded annually?arrow_forward

- When Jose just moved into the town and wanted to set up an internetconnection using AT&T, he was told that the hook up fee is $200. Jose did not havethat much money and wanted to pay for it in the next four months when his part-timejob at the library started. AT&T customer service said that it was fine, but AT&Tdid charge 1% monthly interest rate with monthly compounding. How much will hismonthly installment be in the next four months?arrow_forwardCurrently, student loans have a payoff time of 25 years at an interest rate of about 7.5% compounded monthly. Suppose the remaining principal of your student loan is $33,760 and the remaining payoff time is 15 years at the 7.5% rate. You recently inherited $40,000 and can't decide if you should pay off your student loan or invest the money in a high yield savings account. Before moving on... Determine the total amount of the loan you will pay back after the remaining 15 years.arrow_forwardSuppose Avary, who works for Nasa, buys a fried chicken franchise in Atlanta with a full price of $858,000. Avary will pay 10% of the full price as a downpayment, and will borrow the rest on a 30-year term loan. The annual rate of interest on the loan is 6%, and is compounded monthly. What will the monthly payment be?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,