Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Need correct answer

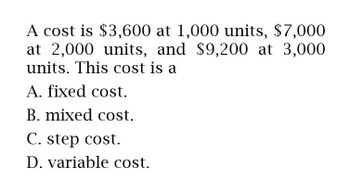

Transcribed Image Text:A cost is $3,600 at 1,000 units, $7,000

at 2,000 units, and $9,200 at 3,000

units. This cost is a

A. fixed cost.

B. mixed cost.

C. step cost.

D. variable cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Tag. General Accountarrow_forwardFrom the below given data, which cost has no relationship with the level of output? Type of cost Amounts (OMR) Total cost 6,000 Variable costs 4,000 Semi variable costs 1,000 Fixed cost 1,000 O a. Variable costs O b. Semi variable costs OC. Total cost Od. Fixed costarrow_forwardGeneral Accountarrow_forward

- Correct Answer✅arrow_forwardGiven the mixed cost function y = $6.50x + $3,000. What does the $6.50 represent? a.Total cost per unit of the cost driver b.The fixed cost per unit c.The slope of the cost function d.Total fixed costsarrow_forwardWhich of the following types of cost is shown in the cost data below? Cost per Number of Unit Units $6,000 3,000 2,000 1,500 a. fixed cost b. mixed cost C. variable cost d. period cost 2. 3. 4.arrow_forward

- Owearrow_forwardThe "x" in the overhead cost equation, y = $5.50x + $92,000, represents which of the following? total overhead costs. the variable costs. total fixed costs. the cost driver in units.arrow_forwardComplete the table below for contribution margin per unit, total contribution margin, and contribution margin ratio: (Click the icon to view the table.) Compute the missing information, starting with scenario A, then for scenarios B and C. (Enter the contribution margin ratio to nearest percent, X%.) A B C 1,290 units 14,390 units 3,600 units 1,400 4,400 $ 1,250 700 880 625 Number of units Sale price per unit Variable costs per unit Calculate: 700 Contribution margin per unit Total contribution margin 903,000 Contribution margin ratio 50% 3520 50,652,800 80% %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College