ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

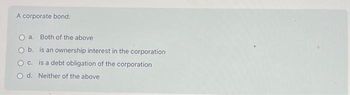

Transcribed Image Text:A corporate bond:

a. Both of the above

b. is an ownership interest in the corporation

c. is a debt obligation of the corporation

O d. Neither of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4. Suppose that there is a tax 7 on the sales of the firm, so that the firm only gets (17) times the quantity produced. The benefit of operating the capital stock for one period is now (1-7). MPK. Use a variational argument as discussed in class to "derive" the new optimality condition of the firm which determines the target capital stock. Show graphically how an increase in the tax on capital will affect the optimal capital stock and hence investment.arrow_forwardpls helparrow_forwardExplain why economic rent is a surplus payment when viewed by the economy as a whole but a cost of production from the standpoint of individual fifirms and industries. Explain: “Land rent performs no ‘incentive function’ for the overall economy.”arrow_forward

- Which of the following statements is FALSE? Select one: Base lending rate of a loan does not depend on the credit risk of borrower Short-term loans are appropriate to finance seasonal increase in inventory of a bank's client The interest rate on a floating rate loan is reset periodically by the bank O d. Higher leverage of a borrower increases the credit risk to the bank O e. All else remaining same, secured loans are usually costlier than unsecured loans to the borrowerarrow_forwardPlz solve it within half n hour... And solve both parts asap i'll upvotearrow_forwardInstead of taking a trip for $3,000, you decide to save your money. How much will you have if you invest that $3,000 at 8% for 10 years? Select one: O a. 4,982.33 O b. 6,496.00 O c. 6,476.77 O d. 4,768.67arrow_forward

- 7arrow_forwarddo fast.arrow_forwardWhich of the following statements regarding immunization is correct? OA. If a bank perfectly matches the maturities of the assets and liabilities, it should achieve perfect immunization for equityholders against interest rate risk. O B. Banks can immunize their portfolios by matching the maturities of their assets with their liabilities. OC. If banks need to satisfy regulatory requirements, they are required to match the durations of their assets with the leverage- adjusted durations of their liabilities. OD. If a bank immunizes a portfolio of its assets or liabilities against interest rate risk, the bank expects that the portfolio will neither gain nor lose its value when interest rates fluctuate.arrow_forward

- 6. Which of the following is a violation of Section 11 of the 1933 Securities Act? O a. Failing to fully disclose accurate information on a registration statement O b. False information in ads c. False information in the prospectus O d. Selling securities without registration and without an exemptionarrow_forwardPLS HELP ASAParrow_forwardHelp pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education