Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

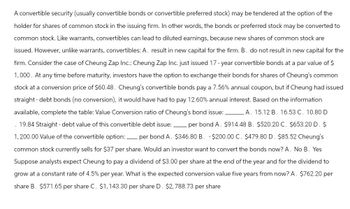

Transcribed Image Text:A convertible security (usually convertible bonds or convertible preferred stock) may be tendered at the option of the

holder for shares of common stock in the issuing firm. In other words, the bonds or preferred stock may be converted to

common stock. Like warrants, convertibles can lead to diluted earnings, because new shares of common stock are

issued. However, unlike warrants, convertibles: A. result in new capital for the firm. B. do not result in new capital for the

firm. Consider the case of Cheung Zap Inc.: Cheung Zap Inc. just issued 17-year convertible bonds at a par value of $

1,000. At any time before maturity, investors have the option to exchange their bonds for shares of Cheung's common

stock at a conversion price of $60.48. Cheung's convertible bonds pay a 7.56% annual coupon, but if Cheung had issued

straight - debt bonds (no conversion), it would have had to pay 12.60% annual interest. Based on the information

available, complete the table: Value Conversion ratio of Cheung's bond issue:_ A. 15.12 B. 16.53 C. 10.80 D

.19.84 Straight - debt value of this convertible debt issue:. per bond A. $914.48 B. $520.20 C. $653.20 D. $

1,200.00 Value of the convertible option: _ per bond A. $346.80 B. -$200.00 C. $479.80 D. $85.52 Cheung's

common stock currently sells for $37 per share. Would an investor want to convert the bonds now? A. No B. Yes

Suppose analysts expect Cheung to pay a dividend of $3.00 per share at the end of the year and for the dividend to

grow at a constant rate of 4.5% per year. What is the expected conversion value five years from now? A. $762.20 per

share B. $571.65 per share C. $1,143.30 per share D. $2,788.73 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Preferred stock is a hybrid security, because it has some characteristics typical of debt and others typical of equity. The following table lists various characteristics of preferred stock. Determine which of these characteristics is consistent with debt and which is consistent with equity. Characteristics Debt Equity Has a par, or face, value. Failure to pay a preferred dividend does not send the firm into bankruptcy. Consider the case of Tamin Enterprises: At the present time, Tamin Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in the future. Tamin has found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend of $14 per share. If the investors pay $130.45 per share for their investment, then Tamin’s cost of preferred stock (rounded to four decimal places) will be .arrow_forwardPreferred stock is a hybrid security, because it has some characteristics typical of debt and others typical of equity. The following table lists various characteristics of preferred stock. Determine which of these characteristics is consistent with debt and which is consistent with equity. Characteristics Has a par, or face, value. Usually has no specified maturity date. Consider the case of Tamin Enterprises: Debt Equity ° At the present time, Tamin Enterprises does not have any preferred stock outstanding but is looking to include preferred stock in its capital structure in the future. Tamin has found some institutional investors that are willing to purchase its preferred stock issue provided that it pays a perpetual dividend of $13 per share. If the investors pay $100.15 per share for their investment, then Tamin's cost of preferred stock (rounded to four decimal places) will bearrow_forwardSelect the answer that contains ONLY potentially dilutive securities. a. convertible debt, junk bonds, preferred stock and warrants b. cumulative preferred stock, warrants, investment-grade bullet bonds and options c. warrants, options and convertible preferredarrow_forward

- A project that costs $3,400 to install will provide annual cash flows of $1,000 for each of the next 6 years. a). What is the NPV if the discount rate is 14%? (Solved, answer is NPV=388.67) b). How high can the discount rate be before you would reject the project? (Do not round intermediate calculations. Enter answers as a percent rounded to 2 decimal places.)arrow_forwardSome financial instruments such as convertible bonds, preferred stocks, warrants and options can have both debt and shareholder’s equity features. They can be converted into common stock or into preferred stocks by investors. This topic has been debated for several years on whether: Viewpoint 1: Issuers should account for an instrument with both liability and equity characteristics entirely as a liability or entirely as an equity instrument depending on which characteristic governs. Viewpoint 2: Issuers should account for an instrument as consisting of a liability component and an equity component that should be accounted for separately. Which of the two viewpoints do you favor? Develop an argument in support of your choice. In considering this question, you should disregard the current position of the FASB on the issue. Instead, focus on conceptual issues regarding the practicable and theoretically appropriate treatment, unconstrained by US GAAP and IFRS. Also, focus your…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education