ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

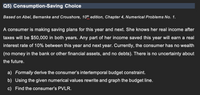

Transcribed Image Text:Q5) Consumption-Saving Choice

Based on Abel, Bernanke and Croushore, 10th edition, Chapter 4, Numerical Problems No. 1.

A consumer is making saving plans for this year and next. She knows her real income after

taxes will be $50,000 in both years. Any part of her income saved this year will earn a real

interest rate of 10% between this year and next year. Currently, the consumer has no wealth

(no money in the bank or other financial assets, and no debts). There is no uncertainty about

the future.

a) Formally derive the consumer's intertemporal budget constraint.

b) Using the given numerical values rewrite and graph the budget line.

c) Find the consumer's PVLR.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Mary has income of $2000 today and $1000 tomorrow. She can lend and borrow at an interest rate of 20%. There is 10% inflation. Her preferences for intertemporal consumption are represented by the following utility function u(c, c) = min{c1, 2c2} (a) What is her optimal consumption bundle?arrow_forwardExercise 5.2 Given the intertemporal production possibilities frontier to the right. Point A represents a production combination of present and future goods. Using the point drawing tool, show a production combination consistent with a decrease in the real interest rate. Label this point 'B'. Carefully follow the instructions above and only draw the required object. Selected: Point tool * Delete Clear Futurn Consumption ? • FC₂ (0,9.93) ........... A PC Present Consumption Q Q G Question Help ▼ Oarrow_forwardAssume an economy with 1000 consumers. Each consumer has income in the current period of 50 units and future income of 60 units, and pays a lump-sum tax of 10 in the current period and 20 in the future period. The market real interest rate is 8%. Of the 1000 consumers, 500 consume 60 units in the future, while 500 consume 20 units in the future. a) Determine each consumer's current consumption and current saving. b) Determine aggregate private saving, aggregate consumption in each period, government spending in the current and future periods, the current-period government deficit, of the quantity of debt issued by the government in the current period. c) Suppose that current taxes increase to 15 for each consumer. Repeat parts (a) and (b) and explain your results.arrow_forward

- Cindy takes a summer job and earns an after-tax income of $5,000. Her living expenses during the summer were $1,000. What was Cindy's saving during the summer and the change, if any, in her wealth? >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign. Cindy's saving during the summer is $arrow_forwardU = c¹/² + Bc¹²/2 tt+1 A) Suppose that the household faces two within period budget constraints of the form: C++ 1 = Y++1 + (1+r)s Combine the two period budget constraints into one intertemporal budget constraint. B) Use the intertemporal budget constraint and this utility function to derive the Euler equation characterizing an optimal consumption plan. C) Use this Euler equation and the intertemporal budget constraint to derive a consumption function expressing cas a function of Y, Y₁+1, and rt.arrow_forwardSuppose you know the following facts about consumer behavior of Amy in 2019. In a year, Amy spends $10000 on basic household items regardless of how much she is earning. For every dollar of disposable income earned, Amy spends 50% on extra purchases. Amy pays taxes in the amount of $1000, and receives no transfers. Use this information to: Derive Amy’s consumption function in nominal terms. Suppose the price level index in the economy for 2019 is estimated to be P = 2. Rewrite the consumption function in real terms.arrow_forward

- Suppose as a hypothetical scenario that you deposit $400 today into a savings account with a variable interest rate and will collect a payment in one year. True or False: If over the course of the year the interest rate falls, this increases the future value of your investment. True Falsearrow_forwardSuppose that there are T periods to maximize over. Show that the intertemporal budget constraint is Ct+2 Yt+2 Yt+1 (1+r) (1+r)² (1 + r)² Ct + Ct+1 (1 + r) + 2+...+ Ct+T+1 (1+r)² \ T = Yt + + +...+ Yt+T+1 (1+r)arrow_forwardConsider the problem of an individual that has Y dollars to spend on consuming over two periods. Let c, denote the amount of consumption that the individual would like to purchase in period 1 and c2 denote the amount of consumption that the individual would like to consume in period 2. The individual begins period 1 with Y dollars and can purchase c1 units of the consumption good at a price P and can save any unspent wealth. Use sı to denote the amount of savings the individual chooses to hold at the end of period 1. Any wealth that is saved earns interest at rate r so that the amount of wealth the individual has at his/her disposal to purchase consumption goods in period 2 is (1+r)s1. This principal and interest on savings is used to finance period 2 consumption. Again, for simplicity, we can assume that it costs P2 dollars to buy a unit of the consumption good in period 2. 2 The individual's total happiness is measured by the sum of period utility across time, u(cı) + u(c2). Let u(c)…arrow_forward

- I need help in solving this problem.arrow_forwardConsider an economy where individuals live for two periods only. Their utility function over consumption in periods 1 and 2 is given by U = 2 log(C1) + 2 log(C2), where C1 and C2 are period 1 and period 2 consumption levels respectively. They have labor income of $100 in period 1 and labor income of $50 in period 2. They can save as much of their income in period 1 as they like in bank accounts, earning interest rate of 5 percent per period. They have no bequest motive, so they spend all their income before the end of period 2. a. What is each individual’s lifetime budget constraint? If they choose consumption in each period so as to maximize their lifetime utility subject to their lifetime budget constraint, what is the optimal consumption in each period? How much do the consumers save in the first period? b. Suppose that the government introduces a social security system that will take $10 from each individual in period 1, put it in a bank account, and transfer it back to…arrow_forwardDescribe the effects of a decrease in the interest rate on present and next period’s consumption if the individual is a net lender (i.e., has savings) after period 1 and the substitution effect is larger than the income effect. Show your answer graphicallyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education