ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

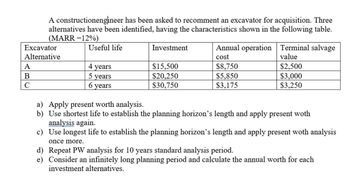

Transcribed Image Text:A constructionengineer has been asked to recomment an excavator for acquisition. Three

alternatives have been identified, having the characteristics shown in the following table.

(MARR =12%)

Useful life

Excavator

Alternative

A

B

с

4 years

5 years

6 years

Investment

$15,500

$20,250

$30,750

Annual operation

cost

$8,750

$5,850

$3,175

Terminal salvage

value

$2,500

$3,000

$3,250

a) Apply present worth analysis.

b) Use shortest life to establish the planning horizon's length and apply present woth

analysis again.

c)

Use longest life to establish the planning horizon's length and apply present woth analysis

once more.

d) Repeat PW analysis for 10 years standard analysis period.

e)

Consider an infinitely long planning period and calculate the annual worth for each

investment alternatives.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardFind the conventional payback period for the following project: First Cost $10,000 $500 in Year 1, increasing by $200/year $3,000/year $4,000 Maintenance Income Salvage Useful Life 10 years MARR 10%arrow_forwardCompare the alternatives below on the basis of their capitalized costs. Assume the MARR is 10% per year, compounded annually Project A Project B Project C First cost ($200,000) ($275,000) ($800,000) Annual income $60,000 $70,000 $80,000 Salvage value $40,000 $60,000 $500,000 Life, years 4 7 infinityarrow_forward

- Please send me answer within 10 min!! I will rate you good for sure!!arrow_forwardCompany X is considering the purchase of a helicopter for connecting services between their base airport and the new inter-county airport being built about 30 miles away. It is believed that the chopper will be needed only for 6 years until the Rapid Transit Connection is phased in. The estimates on two types of helicopters under consideration, The Whirl 2 B and The ROT 8, are given below: The Whirl 2 B First Cost Annual Maintenance Salvage Value Useful life in years $95,000 $3,000 $12,000 The ROT 8 $120,000 $9,000 $25,000 6 3 Assuming that the Whirl 2B will be available in the future with identical costs, what is the annual cost advantage of selecting The Whirl 2B ? (Use an interest rate of 10 %) A. cost more than $4,000 C. cost between $4,000 and $3,000 B. save between $3,000 and $2000 D. save more than $4,000arrow_forwardProblem 05.024 Alternative Comparison - Different Lives You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment. You have identified two alternative sets of equipment and gear. Package K has a first cost of $250,000, an operating cost of $5,500 per quarter, and a salvage value of $30,000 after its 2-year life. Package L has a first cost of $170,000 with a lower operating cost of $3,500 per quarter and an estimated $25,000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 8% per year, compounded quarterly? The present worth of package K is $[ and that of package L is $[ (Click to select) offers the lower present worth.arrow_forward

- Octavia Bakery is planning to purchase one of two ovens. The expected cash flows for each oven are shown below. MARR is 8%/year. Model 127B Model 334A Initial Investment $50,000 $80,000 Estimated Life 10 5 End of Life Salvage $10,000 $0 Annual Income $19,400 $26,000 Annual Expense $10,000 $6,000 2(a) What is the discounted payback period for each investment? 2(b) Which oven should Octavia Bakery purchase if they wish to minimize the DPBP? Answer:arrow_forwardQUESTION 8 For th below two machines and based on AW analysis which machine we should select? MARR=10% Machine A Machine B First cost, $ Annual cost, $/year Salvage value, $ Life, years 3 Answer the below question: B-the AW for machine B= 26,612 12,417 4,135 infinite 140,454 7,170arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education