Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

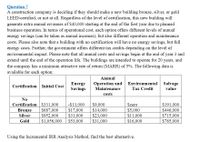

Transcribed Image Text:Question 7

A construction company is deciding if they should make a new building bronze, silver, or gold

LEED-certified, or not at all. Regardless of the level of certification, this new building will

generate extra annual revenues of $40,000 starting at the end of the first year due to planned

business operation. In terms of operational cost, each option offers different levels of annual

energy savings (can be taken as annual incomes), but also different operation and maintenance

costs. Please also note that a building with no certification will have no energy savings, but full

energy costs. Further, the government offers different tax credits depending on the level of

environmental impact. Please note that all annual costs and savings begin at the end of year 3 and

extend until the end of the operation life. The buildings are intended to operate for 20 years, and

the company has a minimum attractive rate of return (MARR) of 5%. The following data is

available for each option:

Annual

Energy

Savings

Operation and

Maintenance

Environmental Salvage

Certification Initial Cost

Tax Credit

value

costs

No

Certification S331,000

$687,000

$952,000

$1,056,000

-S13,000

$17,000

$31,000

S53,000

$9,000

$14,000

$23,000

$31,000

Szero

$5,000

$11,000

$16,000

$191,000

$446,000

$715,000

$785,000

Bronze

Silver

Gold

Using the Incremental IRR Analysis Method, find the best alternative.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- An electronic circuit board manufacturer is considering six mutually exclusive cost-reduction projects for its PC-board manufacturing plant. All have lives of 10 years and zero salvage value. The required investment, the estimated after-tax reduction in annual disbursements, and the gross rate of return arc given for each alternative in the following table: llte rate of return on incremental investments is given for each project as follows: Which project would you select according to the rate of return on incremental investment if it is stated that the MARR is 15%?arrow_forwardSagararrow_forwardAttached is questions diagram, USE EXCEL AS ITS REQUIRED Question 10. Using the replacement chain method (machine B can be replaced with an identical machine at the end of year 3), determine which project should be adopted after tax. Pick the correct answer. Machine A Machine B Either machine Neither machinearrow_forward

- Factor Company is planning to add a new product to its line. To manufacture this product, the company needs to buy a new machine at a $495,000 cost with an expected four-year life and a $10,000 salvage value. Additional annual information for this new product line follows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Required: 1. Determine income and net cash flow for each year of this machine's life. $ 1,960,000 1,502,000 121,250 167,000 2. Compute this machine's payback period, assuming that cash flows occur evenly throughout each year. 3. Compute net present value for this machine using a discount rate of 8%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine income and net cash flow for each year of this machine's…arrow_forwardWhispering Winds Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost $56,525. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,500. At the end of eight years, the company will sell the truck for an estimated $27,600. Traditionally, the company has used a general rule that it should not accept a proposal unless it has a payback period that is less than 50% of the asset's estimated useful life. William Davis, a new manager, has suggested that the company should not rely only on the payback approach but should also use the net present value method when evaluating new projects. The company's cost of capital is 8%. (a) Calculate the cash payback period and net present value of the proposed investment. (If the net present value is negative, use either a…arrow_forwardAn electrical utility is experiencing a sharp power demand that continues to grow at a high rate in a certain local area. Two alternatives are under consideration. Each is designed to provide enough capacity during the next 25 years, and both will consume the same amount of fuel, so fuel cost is not considered in the analysis. • Alternative A. Increase the generating capacity now so that the ultimate demand can be met without additional expenditures later. An investment of $33 million would be required, and it is estimated that this plant facility would be in service for 25 years and have a salvage value of $0.7 million. The annual operating and maintenance costs (including income taxes) would be $0.4 million. salvage • Alternative B. Spend $15 million now and follow this expenditure with future additions during the 10th year and the 15th year. These additions would cost $18 million and $12 million, respectively. The facility would be sold 25 years from now with a value of $1.25…arrow_forward

- Can some one please help me to answer each question correctly? please and thank you.arrow_forwardA manufacturer of automated optical inspection devices is deciding on a project to increase the productivity of the manufacturing processes. The estimated costs for the two feasible alternatives being compared are shown below. Use the internal rate of return (IRR) method to determine which alternative should be selected if the analysis period is 8 years and the company's MARR is 4% per year. Alternative M N Initial costs $30,000 $45,000 Net annual cash flow $4,500 $7,000 Life in years 8 8 (a) IRR of base alternative = (b) IRR of incremental cash flow = (c) Choose Alternativearrow_forwardPlease solve attached question normally, not using excel. thanks!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education