Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting question

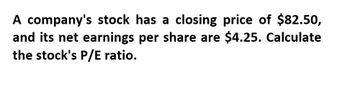

Transcribed Image Text:A company's stock has a closing price of $82.50,

and its net earnings per share are $4.25. Calculate

the stock's P/E ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- JPM has earnings per share of $3.75 and P/E of 47. What is the stock price?arrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forwardPQR Co. has earnings of $2.66 per share. The benchmark PE for company is 19. What stock price (to two decimals) would you consider appropriate?arrow_forward

- Calculate the missing information for the following stock. Show your work. Company Earnings per Share Annual Dividend Current Price per Share Current Yield Price-Earnings Ratio Sampson, Inc. ? $0.39 $26.50 ? 22arrow_forwardPfizer, Inc. (PFE) has earnings per share of $2.09 and a P/E ratio of 11.02. What is the stock price?arrow_forwardA company's stock is trading at $50 per share with a price-to-earnings (P/E) ratio of 20. What is the company's earnings per share (EPS)? a) $1.50 b) $2.00 c) $2.50 d) $3.00arrow_forward

- Compute the percentage of total return? General accountingarrow_forwardCalculate The Market Price with General Accounting methodarrow_forwardABD common stock is selling for $36.08 a share. The company has earnings per share of S.34 and a book value per share of S12.19. What is the market-to-bok ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,