Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

None

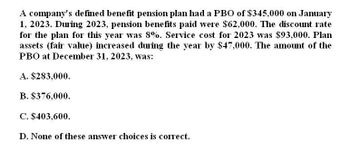

Transcribed Image Text:A company's defined benefit pension plan had a PBO of $345,000 on January

1, 2023. During 2023, pension benefits paid were $62,000. The discount rate

for the plan for this year was 8%. Service cost for 2023 was $93,000. Plan

assets (fair value) increased during the year by $47,000. The amount of the

PBO at December 31, 2023, was:

A. $283,000.

B. $376,000.

C. $403,600.

D. None of these answer choices is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pinecone Company has plan assets of 500,000 at the beginning of the current year and expects to earn 12% on its plan assets during the year. Pinecones service cost is 230,000, and its interest cost is 55,000. Compute Pine-cones pension expense for the current year.arrow_forwardGet correct answer with general accountingarrow_forwardGeneral accountingarrow_forward

- Horizon Inc. has a defined benefit pension plan. The following pension-related data were available for the current calendar year: PBO: Balance, Jan. 1 $ 235,000 Service cost 36,000 Interest cost (5% discount rate) 11,750 Gain from changes in actuarial assumptions in 2021 (4,500 )Benefits paid to retirees (15,000 )Balance, Dec. 31 $ 263,250 Plan assets: Balance, Jan.1 $ 245,000 Actual return (expected return was $22,000) 20,000 Contributions 30,000 Benefits paid (15,000 )Balance, Dec. 31 $ 280,000 ABO, Dec. 31 $ 239,500 January 1, 2021, balances: Prior service cost–AOCI (amortization $5,075/yr.) 5,075 Net gain–AOCI (amortization, if any, over 15 years) 50,750 There were no other relevant data. Required:1. Calculate the 2021 pension expense.2. Prepare the 2021 journal entries to record pension expense and funding.3. Prepare any journal entries to record any 2021 gains or losses.arrow_forwardPresented below is pension information related to Sofa Inc. for the calendar year 2023: Current service costs $ 288,000 Defined benefit expense for 2023 480,000 Expected and actual return on plan assets 72,000 Past service costs 48,000 The interest on the accrued pension obligation for 2023 is a) $312,000. b) $216,000. c) $168,000. d) $144,000.arrow_forwardRichmond Company's defined benefit pension plan had a Projected Benefit Obligation (PBO) of $250,000 on January 1, 2021. During 2021, a) Richmond paid pension benefit: of $30,000, b) the plan's discount rate was 10%; c) the plan's service cost was $95,000; and d) the plan assets increased by $70,000. What is the value of Richmond's PBO at December 31, 2021? Multiple Choice $270,000 O $340,000 O $245,000 O $410,000arrow_forward

- On January 1, 2020, McGee Co. had the following balances: Projected benefit obligation $7,800,000 Fair value of plan assets 7,800,000 Other data related to the pension plan for 2020: Service cost 315,000 Contributions to the plan 459,000 Benefits paid 450,000 Actual return on plan assets 444,000 Settlement rate 9% Expected rate of return 6% Instructions (a) Determine the projected benefit obligation at December 31, 2020. There are no net gains or losses. (b) Determine the fair value of plan assets at December 31, 2020. (c) Calculate pension expense for 2020. (d) Prepare the journal entry to record pension expense and the contributions for 2020.arrow_forwardAt January 1, 2025, Ivanhoe Company had plan assets of $300,400 and a projected benefit obligation of the same amount. During 2025, service cost was $27,500, the settlement rate was 10%, actual and expected return on plan assets were $25,900, contributions were $20,100, and benefits paid were $17,800. Prepare a pension worksheet for Ivanhoe for 2025. (Enter all amounts as positive.) Items Pension Expense $ Balance 1/1/25 Service cost Interest cost Actual return Contributions Benefits $ Journal entry IVANHOE COMI General Journal Entries $ Cash Balance, 12/31/25 Prepare a pension worksheet for Ivanhoe for 2025. (Enter all amounts as positive.) HOE COMPANY Pension Asset/Liability > > Memo Record Projected $ Benefit Obligation > > > > $ > > > > A $ Plan Assetsarrow_forwardAt January 1, 2025, Crane Company had plan assets of $254,500 and a projected benefit obligation of the same amount. During 2025, service cost was $26,600, the settlement rate was 10%, actual and expected return on plan assets were $24,500, contributions were $20,800, and benefits paid were $16,800. Prepare a pension worksheet for Crane for 2025.arrow_forward

- On January 1 2025 strott company had a projected benefit obligation of 3,000,000. the company amended its defined benefit plan which resulted in an increase to prior service costs of 800,000 on January 1 2025. the discount rate is 8%. when interest is calculated on the projected benefit obligation in 2025, what is the journal entry? A DR to pension expense $64,000 B debit to pension expense $304,000 C credit to projected benefit obligation $64,000 D credit to projected benefit obligation $304,000 E credit to other comprehensive income $64,000 F credit to other comprehensive income $304,000arrow_forwardhi expert please help mearrow_forwardA company had the following information about the company's defined-benefit pension plan: January 1, 2021 December 31, 2021Projected benefit obligation $80,000 $93,000Fair value of pension plan assets 41,000 51,000Actual return on plan assets is $13,000. The service cost component of pension expense for 2021 is $17,200. The expected rate of return is 11% and the settlement rate is 6%. Given the information provided, what is the amount of pension expense for 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT