Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What was the variable overhead

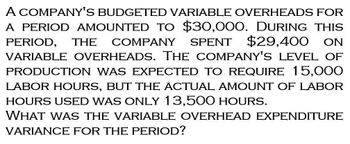

Transcribed Image Text:A COMPANY'S BUDGETED VARIABLE OVERHEADS FOR

A PERIOD AMOUNTED TO $30,000. DURING THIS

PERIOD, THE COMPANY SPENT $29,400 ON

VARIABLE OVERHEADS. THE COMPANY'S LEVEL OF

PRODUCTION WAS EXPECTED TO REQUIRE 15,000

LABOR HOURS, BUT THE ACTUAL AMOUNT OF LABOR

HOURS USED WAS ONLY 13,500 HOURS.

WHAT WAS THE VARIABLE OVERHEAD EXPENDITURE

VARIANCE FOR THE PERIOD?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardFlaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forwardAt the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forward

- The overhead at the end of the month would therefore be ?arrow_forwardprovide correct answer is.arrow_forwardA company estimates its manufacturing overhead will be $525,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 42,000 per direct labor hour B. Budgeted direct labor expense: $1,050,000 per direct labor dollar C. Estimated machine hours: 70,000 per machine hourarrow_forward

- Please give me answer general accounting questionarrow_forwardHow much are total overhead costs at this level of activity of this general accounting question?arrow_forwardA company applies overhead based on standard direct labor hours. The following data is available: 1. Total budgeted fixed overhead cost for the year = $450,000 2. Actual fixed overhead cost for the year = $460,000 3. Budgeted standard direct labor hours (denominator level of activity) = 55,000 4. Actual direct labor hours = 57,000 5. Standard direct labor hours allowed for actual output = 52,000 Required: A. Compute the fixed portion of the predetermined overhead rate. B. Compute the fixed overhead budget and volume variances.arrow_forward

- How much are total overhead costs?arrow_forwardnormal capacity for horizon manufacturing?arrow_forwardA company estimates its manufacturing overhead will be $1,080,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 72,000 $fill in the blank 1 per direct labor hour B. Budgeted direct labor expense: $1,800,000 $fill in the blank 2 per direct labor dollar C. Estimated machine hours: 120,000 $fill in the blank 3 per machine hourarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning